According to a report by the Chosun Ilbo, liquefied natural gas (LNG) carriers are among the ship types in which South Korea holds the most competitive edge. Currently, over 50% of the profits of South Korea’s domestic shipbuilding industry come from LNG carriers.

However, the core technology of LNG carriers—LNG cargo hold containment technology—has long been monopolized by the French company GTT. Reportedly, South Korean shipbuilders are required to pay GTT a 5% royalty/service fee for each LNG carrier delivered, amounting to 10 billion to 20 billion won (approximately 7.22 million to 14.45 million US dollars) per ship.

According to reports, LNG cargo tank technology has high technical scalability and is not only applicable to LNG, but also to next-generation cargo tanks such as liquid hydrogen and liquid ammonia. In order to achieve domestic production of this technology, HD Hyundai and Samsung Heavy Industries are currently promoting the development of a “Korean-style cargo hold model.” The two companies have completed concept verification for small and medium-sized ships, but have not yet conducted verification for large LNG carriers.

On August 22, the South Korean government announced its goal in the “New Government Economic Growth Strategy, 15 Major Projects for Ultra-Innovation” to actively support domestic shipyards in developing South Korean LNG cargo tank technology and plans to build two ships using this technology by 2028.

Related plans include: supporting the research and development of automated production processes for Korean-style cargo holds insulation panels in the second half of this year; starting next year, promoting the domestic production of cargo materials and components, with large-scale financial support.

A South Korean government official said, “We will prevent the outflow of national wealth and establish a leading position in future market technologies by promoting the track record (proof-of-concept results) for Korean-style LNG cargo hold technology.”

In order to break GTT’s monopoly, South Korea has been developing its own LNG cargo tank technology in recent years.

In 2014, Korea Gas Corporation (KOGAS) launched its “KC-1” technology after 10 years of research and development. However, the “KC-1” technology experienced major malfunctions during actual ship application, resulting in two 174,000-cubic-meter LNG carriers built by Samsung Heavy Industries and equipped with the technology being unable to enter service.

Since their delivery, these ships have experienced issues such as natural gas leaks, cracks, and ice formation on the outer walls of the cargo holds, requiring multiple repairs. Due to these problems, Samsung Heavy Industries and the shipowner SK Shipping filed a lawsuit against KOGAS. Ultimately, the court ruled that KOGAS must pay more than 188 billion won in compensation to the shipyard and the shipowner.

Despite the problems with the “KC-1” technology, South Korean companies subsequently promoted the development of the second-generation LNG liquid cargo tank technology “KC-2” to address the defects of the “KC-1”.

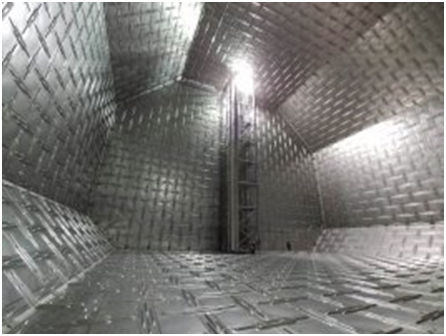

In May 2023, the naming ceremony for the “Blue Whale,” South Korea’s first 7,500-cubic-meter LNG bunkering vessel equipped with a domestically produced LNG cargo containment system, was held. The “Blue Whale” is the first ship to be equipped with the “KC-2” technology. Compared to the first-generation Korean cargo tank technology, the “KC-1,” the “KC-2” boasts enhanced thermal insulation and is easier to install. It also reduces the LNG boil-off rate (BOR) and further improves economic efficiency.