On November 17, China’s largest private shipbuilder Yangzijiang Shipbuilding Group released its third-quarter performance report for 2025. As of September 30, 2025, the Group’s order backlog reached 8.77 million compensated gross tonnage(CGT, 245 vessels) with a total value of US$22.83 billion, extending delivery schedules through 2030. New orders secured included 50 vessels valued at $2.17 billion, comprising 38 container ships, 10 bulk carriers, and 2 gas carriers.

Handheld orders: 245 vessels / Value: $22.83 billion

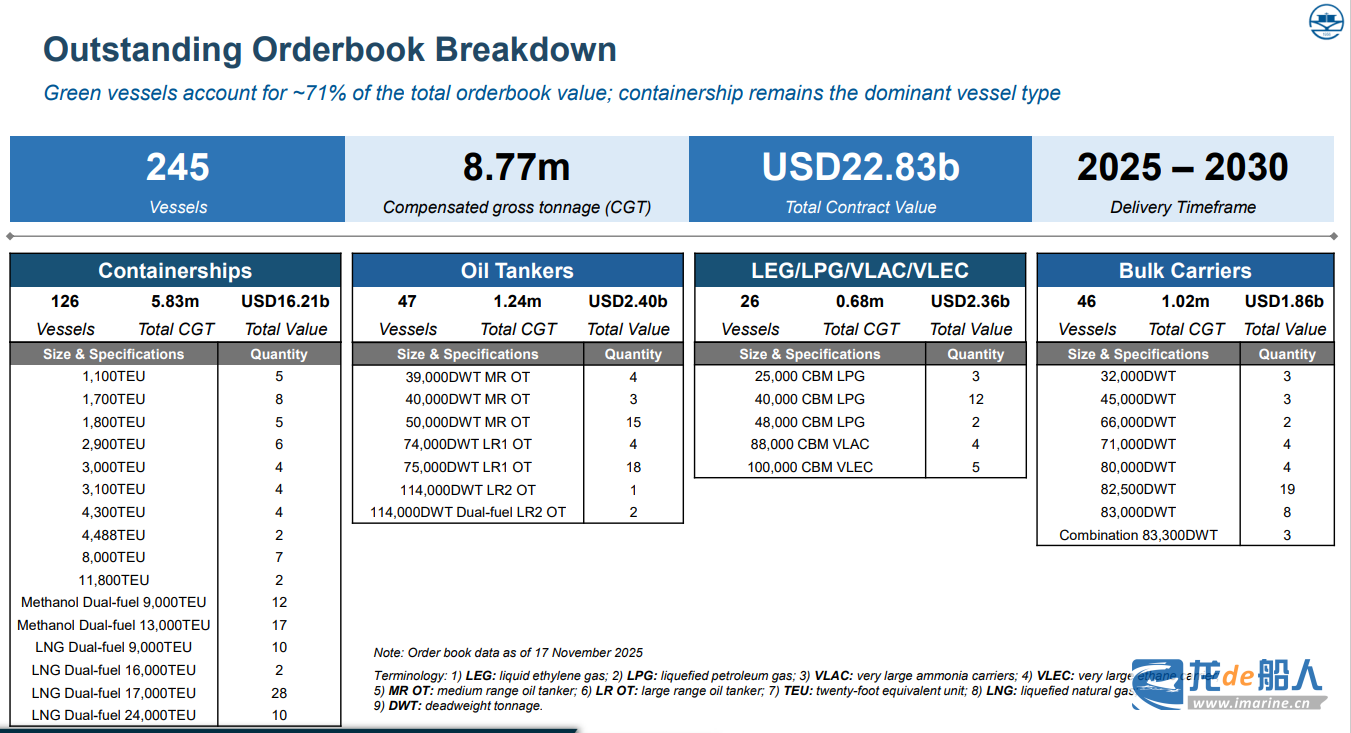

The announcement disclosed that as of September 30, 2025, Yangzijiang Shipbuilding had accumulated orders totaling 245 vessels valued at US$22.83 billion, with delivery schedules extending through 2030. Clean energy vessels accounted for approximately 71% of the order book, encompassing multiple ship types including container ships, bulk carriers, gas carriers, and tankers, with container ships constituting the majority. Details are as follows:

The container ship order book stands at 5.83 million CGT (126 vessels), valued at US$16.21 billion. This includes 10 24,000 TEU LNG dual-fuel container ships, 28 17,000 TEU LNG dual-fuel container ships, 2 16,000 TEU LNG dual-fuel container ships, 10 9,000 TEU LNG dual-fuel container ships, 17 13,000 TEU methanol dual-fuel container ships, 12 9,000 TEU methanol dual-fuel container ships, 2 11,800 TEU container ships, 7 8,000 TEU container ships, 2 4,488 TEU container ships, 4 4,300 TEU container ships, 4 3,100 TEU container ships, 4 3,000 TEU container ships, 6 2,900 TEU container ships, 5 1,800 TEU container ships, 8 1,700 TEU container ships and 5 1,100 TEU container ships.

Compared to the half-year order data disclosed in August this year, Yangzijiang Shipbuilding’s third-quarter order focus shifted to the small and medium-sized container ship market.

Handheld orders for oil tankers reached 1.24 million CGT (47 vessels), valued at US$2.4 billion. This includes: 4 39,000 DWT MR product tankers 3 40,000 DWT MR product tankers 15 50,000 DWT MR product tankers 4 74,000 DWT LR1 product tankers 18 x 75,000 DWT LR1 product tankers 1 LR2 product tanker of 114,000 DWT, and 2 114,000 DWT methanol-ready LR2 product tankers.

Handheld orders for LPG/LEG/VLEC/VLAC carriers reached 680,000 CGT (26 vessels), valued at US$2.36 billion. This includes 3 25,000-cubic-meter LPG carriers, 12 40,000-cubic-meter LPG carriers, 2 48,000-cubic-meter LPG carriers, 4 88,000-cubic-meter VLACs and 5 100,000-cubic-meter VLECs.

The bulk carrier order backlog stands at 1.02 million CGT (46 vessels) and is valued at US$1.86 billion. This includes 3 32,000 DWT bulk carriers, 3 45,000 DWT bulk carriers, 2 66,000 DWT bulk carriers, 4 71,000 DWT bulk carriers, 4 80,000 DWT bulk carriers, 19 82,500 DWT bulk carriers, 8 83,000 DWT bulk carriers, and 3 Combination 83,300 DWT bulk carriers.

New orders for 50 vessels worth US$2.17 billion

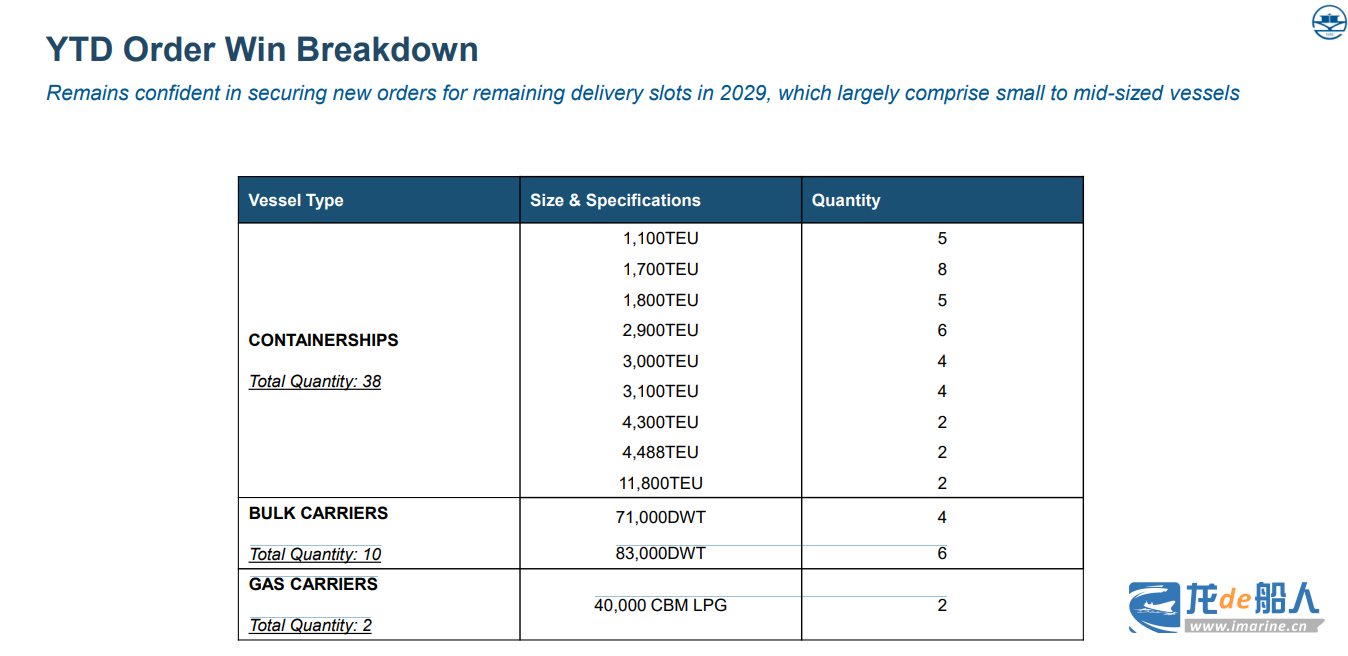

According to the announcement, Yangzijiang Shipbuilding has secured orders for 50 new vessels worth US$2.17 billion so far this year. These include 38 container ships, 10 bulk carriers, and 2 gas carriers, scheduled for delivery between 2027 and 2029.

Specifically, this includes 5 container ships of 1,100 TEU, 8 container ships of 1,700 TEU, 5 container ships of 1,800 TEU, 6 container ships of 2,900 TEU, 4 container ships of 3,000 TEU, 4 container ships of 3,100 TEU, 2 container ships of 4,300 TEU, 2 container ships of 4,488 TEU, and 2 container ships of 11,800 TEU; 4 bulk carriers of 71,000 deadweight tons, 6 bulk carriers of 83,000 deadweight tons; and 2 LPG carriers of 40,000 cubic meters.

Delivered 46 new vessels

As of September 30, 2025, Yangzijiang Shipbuilding had completed and delivered a total of 46 new vessels, achieving approximately 82% of its annual target of 56 deliveries. This included 16 container ships, 6 bulk carriers, 3 gas carriers, and 21 oil tankers/chemical tankers.

Ren Letian, Chairman and CEO of Yangzijiang Shipbuilding, commented on the company’s operational performance, stating, “With the global macroeconomic outlook becoming increasingly clear and customer confidence gradually recovering, order momentum is showing a moderate recovery trend. Nevertheless, the industry-wide order backlog remains at a historical high, with delivery cycles approaching five years, and delivery schedules for large vessels at leading shipyards are extremely limited. Therefore, shipowners and shipyards remain cautious about delivery plans for 2030 and beyond. The Group will continue to focus on high-quality, on-time delivery of existing orders to support stable profitability and sustainable shareholder returns. At the same time, the Group is actively filling the remaining delivery period in 2029, mainly involving small and medium-sized vessels.”