Fincantieri, one of the world’s largest shipbuilding groups, has officially released its financial results for the first three quarters of 2025. All business sectors achieved robust growth, with profitability significantly enhanced. The company’s order backlog exceeds US$70.4 billion, with delivery schedules extending through 2036.

In the first nine months of 2025, the backlog increases by 32% versus FY 2024 to euro 41.0 billion, with 100 ships in the portfolio and deliveries scheduled until 2036. Soft backlog reaches euro 20.1 billion, leading to a total backlog of euro 61.1 billion, equal to 7.5 times 2024 revenues.

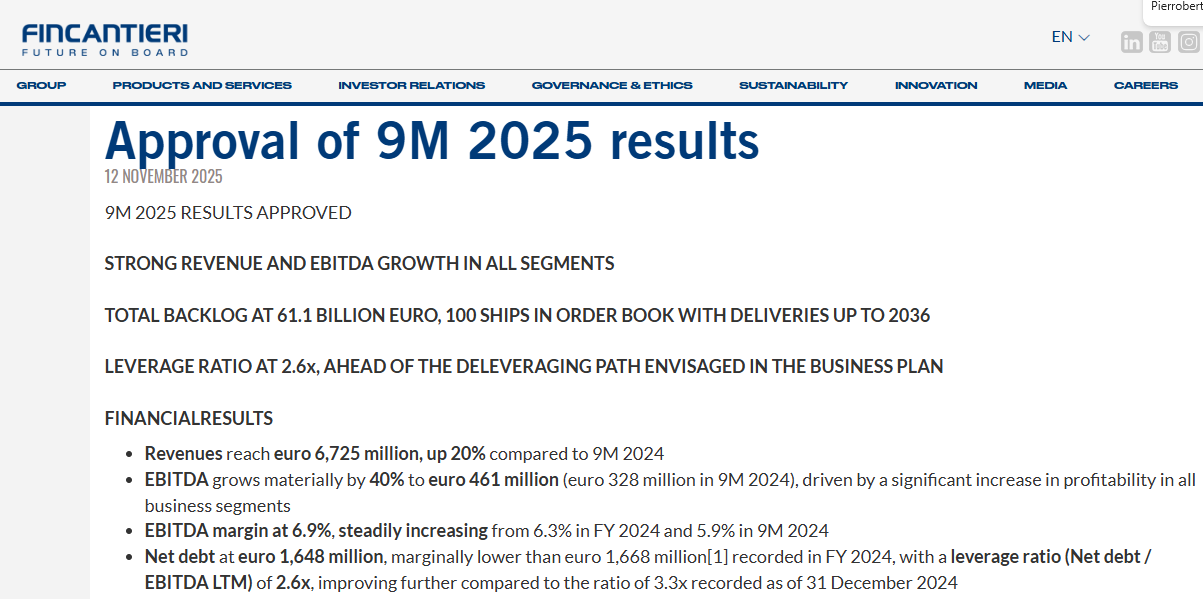

Fincantieri’s strong performance continues in the first nine months of 2025, driven by a positive contribution from all businesses, with revenues reachingapproximately euro 6.7 billion, up by 20% compared to 30 September 2024. Profitability also increases materially, with EBITDA growing by 40% year-on-year to euro 461 million with an EBITDA margin of 6.9%, confirming a sustained and continuous growth path compared to 6.3% at the end of 2024 and 5.9% in the first nine months of 2024.

Commercial/Order Book Segment: In the first nine months of this year, Fincantieri’s total order backlog reached euro 61.1 billion, setting a new record high equivalent to 7.5 times its 2024 revenue. This includes confirmed orders valued at euro 41.0 billion (approximately US$47.6 billion) and letter-of-intent orders valued at euro 20.1 billion (approximately US$23.3 billion), with confirmed order value growing 32% year-on-year. In terms of new ship orders, the order backlog stands at 100 vessels, with delivery schedules extending through 2036.

The Shipbuilding segment posts an EBITDA growth of 33% compared to the first nine months of 2024 and an EBITDA margin further improving to 6.5% (6.0% in the first nine months of 2024), mainly due to the operational efficiency measures undertaken by the Group in the Cruise sector, as set out in the Business Plan, and to the stronger contribution from the Defense business, also thanks to the sale of 2 MPCS/PPA units to the Indonesian Ministry of Defense finalized in the first quarter of 2025.

The Underwater segment contributes markedly to the Group’s results at the end of the period, with an EBITDA margin at 17.3%. The Equipment, Systems and Infrastructure segment records a solid year-on-year increase in EBITDA by 37%, with an EBITDA margin of 7.4% (5.4% in the first nine months of 2024), primarily driven by the performances of the Mechanical Systems and Components Cluster (EBITDA margin at 14.0% vs 10.7% in the first nine months of 2024) and the Infrastructure Cluster (EBITDA margin at 7.1% vs 4.8% at September 30, 2024).

On the commercial front, order intake in the first nine months of 2025 reaches euro 16.0 billion, increasing by 88% year on year, and higher than the orders acquired in the whole of 2024, driven in particular by the Shipbuilding segment (+130% compared to the first nine months of 2024). At the end of the period, the book-to-bill (orders/revenues) stands at 2.4x, with a commercial pipeline underpinned by strong demand in the Group’s core businesses.

In the first nine months of 2025, the backlog increases by 32% versus FY 2024 to euro 41.0 billion, with 100 ships in the portfolio and deliveries scheduled until 2036. Soft backlog reaches euro 20.1 billion, leading to a total backlog of euro 61.1 billion, equal to 7.5 times 2024 revenues.

Net debt stands at euro 1,648 million at the end of the period, in line with the euro 1,644 million recorded at the end of the first half of 2025, and slightly better than the 2024 year-end figure of euro 1,668 million[4], resulting in a leverage ratio (Net debt / EBITDA LTM[5]) of 2.6x, improving compared to the 3.3x ratio recorded at 31 December 2024.

Pierroberto Folgiero, Chief Executive Officer and Managing Director of Fincantieri, said: “We are very satisfied and deeply grateful to all the people at Fincantieri for their outstanding work. We continue to deliver solid growth in revenues, margins, and orderbook, resulting in three mutually reinforcing positive effects: the consolidation of the Group’s strong financial and operational performance achieved over the past three years; the Company’s strong positioning within a favorable industrial cycle that is shaping the future of the sector; and the creation of shared and sustainable value for all social and financial stakeholders.

With an all-time record total backlog of over 60 billion euro spanning the next ten years and 80% of our procurement sourced from Italian suppliers, Fincantieri’s contribution to the national and local economies continues to grow, generating significant financial visibility across the supply chain and sustaining stable employment. At the same time, the Group continues to enhance its role as a driver of Italy’s strategic innovation, thanks to: the launch of the first autonomous underwater drones for the protection of critical subsea and port infrastructures; the entry into the market of military unmanned surface vehicles for coastal surveillance; the start of domestic production of fuel cell propulsion systems and battery packs for both defense and commercial applications; and the establishment of Fincantieri Ingenium, dedicated to creating a digital data and application platform enabling the use of artificial intelligence in ship operations and in port ecosystems. Finally, we continue to work intensively to increase production capacity in both commercial and defense shipbuilding by increasing the productivity of our assets, supporting the development of skilled labor and introducing new technologies and work methods to the production processes.”