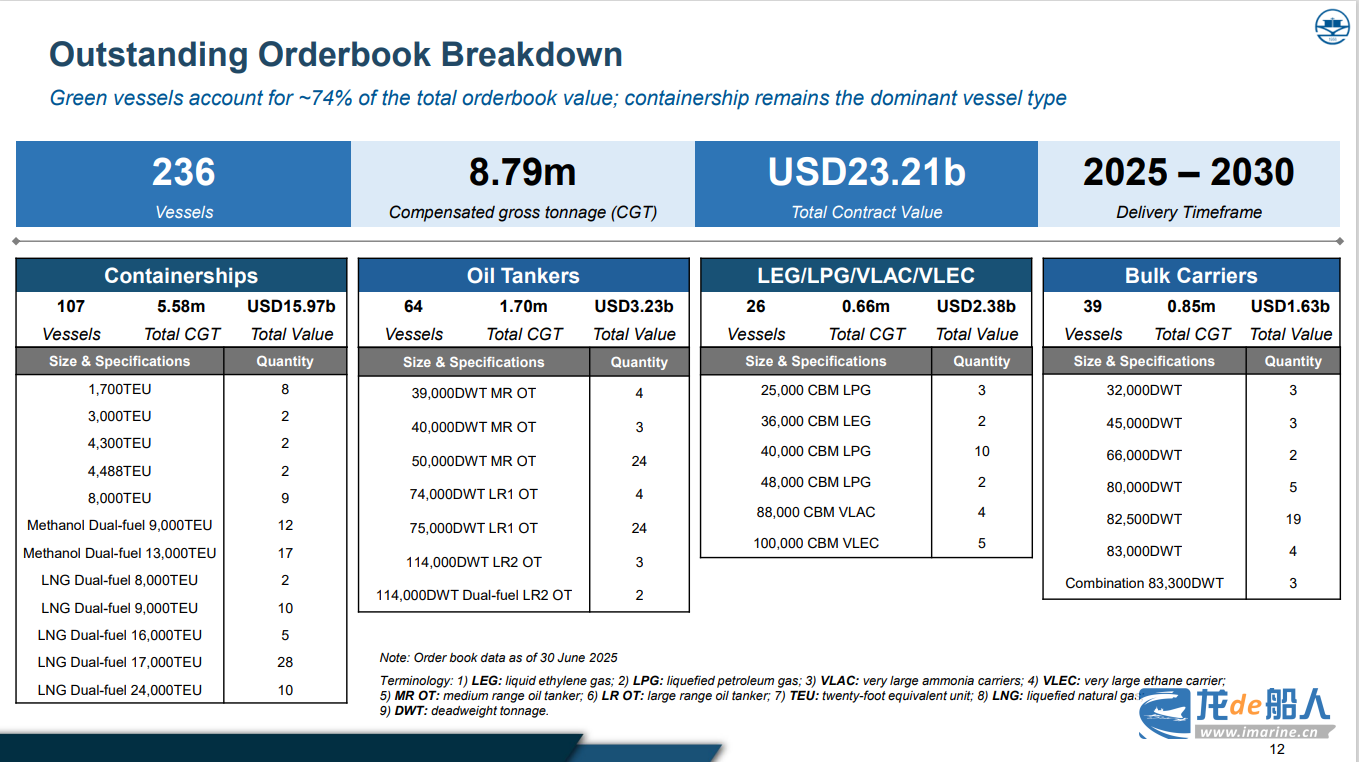

On August 6, Yangzijiang Shipbuilding Group released its “Financial Results for the First Half of 2025”. As of June 30, 2025, Yangzijiang Shipbuilding Group’s order backlog reached 8.79 million compensated gross tonnage(CGT, 236 ships), with an order value of US$23.21 billion, and delivery dates were scheduled until 2030; 14 new ships were signed, worth US$540 million, including 12 container ships and 2 bulk carriers.

During the reporting period, Yangzijiang Shipbuilding’s total revenue remained relatively stable at RMB 12.9 billion (approximately US$1.797 billion). The shipping segment generated RMB 510 million (approximately US$71 million) in revenue. Net profit attributable to shareholders increased 37% year-on-year in the first half of 2025 to a record high of RMB 4.2 billion (approximately US$585 million).

Order Backlog: 236 ships valued at US$23.21 billion

The announcement disclosed that as of June 30, 2025, Yangzijiang Shipbuilding had a cumulative order book of 236 ships worth US$23.21 billion, with delivery scheduled until 2030. Clean energy ship orders accounted for approximately 74%, covering multiple ship types including container ships, bulk carriers, gas carriers, and oil tankers, as follows:

The container ship order book reached 5.58 million CGTs (107 ships), valued at US$15.97 billion, including 10 24,000 TEU LNG dual-fuel powered container ships, 28 17,000 TEU LNG dual-fuel powered container ships, 5 16,000 TEU LNG dual-fuel powered container ships, 10 9,000 TEU LNG dual-fuel powered container ships, 2 8,000 TEU LNG dual-fuel powered container ships, 17 13,000 TEU methanol dual-fuel powered container ships, 12 9,000 TEU methanol dual-fuel powered container ships, 9 8,000 TEU container ships, 2 4,488 TEU container ships, 2 4,300 TEU container ships, 2 3,000 TEU container ships and 8 1,700 TEU container ships.

The order book for bulk carriers reached 850,000 CGTs (39 ships) and was valued at US$1.63 billion, including three 32,000 DWT bulk carriers, three 45,000 DWT bulk carriers, two 66,000 DWT bulk carriers, five 80,000 DWT bulk carriers, 19 82,500 DWT bulk carriers, four 83,000 DWT bulk carriers and three Combination 83,300 DWT bulk carriers.

The order book for LPG/LEG/VLEC/VLAC carriers reached 660,000 CGTs (26 ships) with a value of US$2.38 billion, including 2 36,000 cubic meter LEG carriers, 5 100,000 cubic meter VLECs, 3 25,000 cubic meter LPG carriers, 10 40,000 cubic meter LPG carriers, 2 48,000 cubic meter LPG carriers and 4 88,000 cubic meter VLACs.

The tanker order book reached 1.7 million CGTs (64 ships) with a value of US$3.23 billion, including 4 39,000 DWT MR product tankers, 3 40,000 DWT MR product tankers, 24 50,000 DWT MR product tankers, 4 74,000 DWT LR1 product tankers, 24 75,000 DWT LR1 product tankers, 3 114,000 DWT LR2 product tankers and 2 114,000 DWT methanol-ready LR2 product tankers.

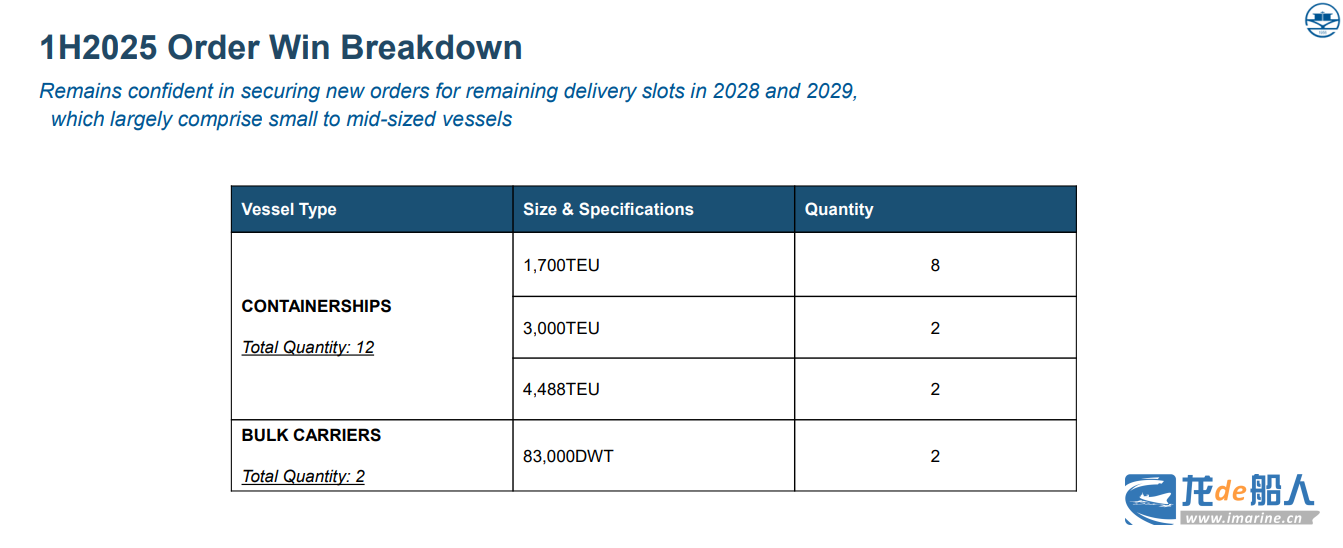

New orders: 14 ships/valued at US$540 million

According to the announcement, Yangzijiang Shipbuilding has received 14 new ship orders worth US$540 million this year, including 12 container ships and 2 bulk carriers, achieving about 9% of its annual order target of US$6 billion.

Specifically, this includes eight 1,700 TEU container ships, two 3,000 TEU container ships, two 4,488 TEU container ships and two 83,000 DWT bulk carriers.

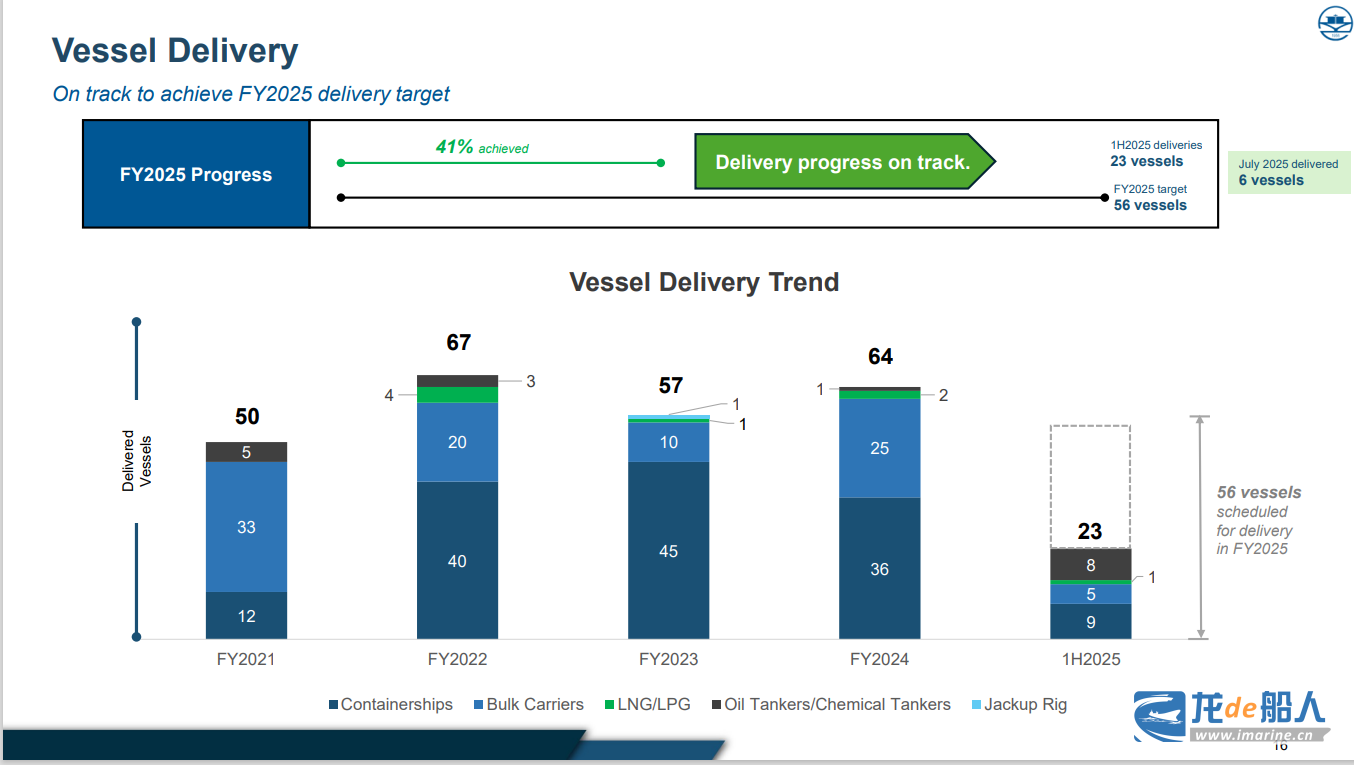

Delivery of new ships: 23

As of June 30, 2025, Yangzijiang Shipbuilding had completed and delivered a total of 23 new ships, achieving approximately 41% of its annual target of 56 ship deliveries, including 8 container ships, 5 bulk carriers, 1 gas carrier, and 9 oil/chemical tankers.

Ren Letian, Chairman and CEO of Yangzijiang Shipbuilding, stated: “In the first half of 2025, facing complex challenges such as global shipping market volatility and international policy risks, Yangzijiang Shipbuilding remained committed to its core objectives of ensuring ship delivery, order acceptance, and project success. Through a series of initiatives, including optimizing production processes, strengthening supply chain collaboration, and implementing refined management, we continuously improved shipbuilding efficiency and quality. During this period, Yangzijiang Shipbuilding’s shipbuilding gross profit margin reached a new high of 35%.

Currently, construction of the Yangzi Hongyuan Green High-tech Clean Energy Ship Manufacturing Base project is proceeding as schedule, with completion planned for the end of 2026 and the first newbuilding expected to be delivered in 2027. The project, with a total investment of approximately RMB 3 billion, will become the primary base for Yangzijiang Shipbuilding’s current orders for green and clean energy ships. The project will utilize approximately 1,320 meters of shoreline to construct a 300,000-ton shipbuilding dock, a 200,000-ton outfitting pier, and a 100,000-ton harbor, with an annual production capacity of approximately 800,000 deadweight tons.

Yangzijiang Shipbuilding is actively planning and implementing orders for new ships suitable for construction at the Yangzi Hongyuan plant. This move will further consolidate and expand the company’s competitiveness in receiving orders and order backlog.

In addition, Yangzijiang Shipbuilding completed its investment in Zhoushan Tsuneishi Shipbuilding in the first half of this year. Zhoushan Tsuneishi Shipbuilding has become an associate company of Yangzijiang Shipbuilding, with a 34% equity stake.

In the future, Yangzijiang Shipbuilding will continue to closely monitor market trends, dynamically optimize its business strategies and accurately seize emerging market opportunities. Relying on a prudent business philosophy and a robust financial structure, it is committed to creating sustainable long-term investment returns for shareholders.