Despite market uncertainties, container ship orders remain strong and continue to grow. The latest report from Linerlytica, an Asian container consulting firm, points out that while container ship orders continue to grow, they have also triggered a new round of concerns.

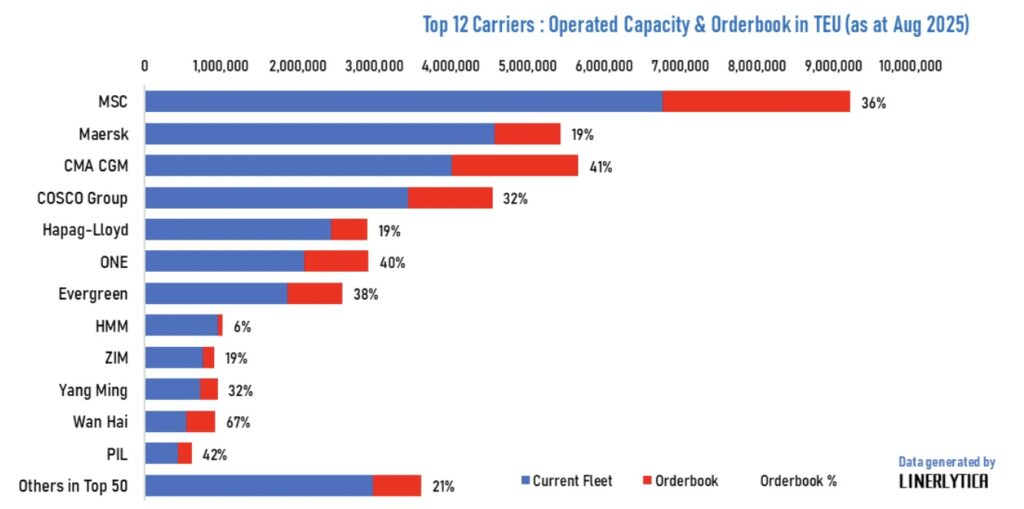

Major container shipping companies account for the vast majority of new ship orders. For example, Mediterranean Shipping Company (MSC) accounts for one-third of the current fleet capacity, with a total fleet capacity of 6.6 million TEU, according to Alphaliner data; CMA CGM and ONE have both placed orders exceeding 40% of their current fleet capacity; and orders from COSCO Shipping and Evergreen Marine both exceed 30% of their current fleet capacity.

Linerlytica statistics show that after a surge in orders in the past 12 months, total container ship orders have reached a record 10.4 million TEUs, accounting for 31.7% of the global container fleet capacity, the highest level since 2010.

It is worth noting that the statistical value of 10.4 million TEU is slightly higher than the data provided by other professional institutions. For example, Clarkson published data of 9.87 million TEU, which is similar to Alphaliner’s data. At the same time, shipping companies such as Evergreen Marine and HMM are negotiating more new shipbuilding projects.

Linerlytica warned in its report: “The last time the order volume exceeded this level was between 2004 and 2009, which ultimately led to a decade-long supply surplus that took ten years to resolve.”

At the same time, some shipping companies are pushing ahead with fleet renewal. For example, Maersk’s order volume is already close to 20% of its own capacity. In 2024, Maersk indicated that it will focus on fleet modernization and renewal, and announced plans to maintain its current capacity level of around 4.6 million TEU.

Currently, the container ship market is booming, but recent financial reports show that the industry is still under pressure due to rising costs and uncertainty in freight rates.

Linerlytica points out that only 0.3% of the global container fleet is currently idle. Over the past 30 days, 19 new ships have been delivered, increasing capacity by 184,000 TEU, while only three ships with a total capacity of 3,000 TEU have been taken out of service.

The expansion of shipping capacity comes amid ongoing tensions over US tariffs and uncertainty over the short-term implementation of tariff policies. The closure of the Red Sea and Suez Canal routes has driven up demand for shipping capacity, but analysts are now questioning the impact of US tariffs, planned US port fees on Chinese-built ships, and the overall health of the global economy.

Linerlytica points out that an additional 1 million TEU of capacity will be created by the end of this year, but the growth rate will slow down. The first wave of orders occurred during and after the pandemic, but then stagnated, which will lead to a slowdown in capacity growth in 2026 and 2027.

The ships ordered during this surge in orders will be delivered and put into service in 2028 and 2029. Although more ships are adopting dual-fuel or alternative fuel designs, the shipping industry still needs to take more proactive measures to respond to new environmental regulations. This may result in some of the ships delivered in the future being used to replace the aging fleet, but Linerlytica points out that the current order volume remains a cause for concern.

The huge order volume has prompted Linerlytica to predict that the container shipping industry will face a supply-demand imbalance before the end of this decade. Linerlytica points out: “Containership fleet growth will continue to outpace demand growth, with excess supply projected to persist through 2029”.

According to data from freight rate platform Xeneta, the global shipping fleet currently stands at 145 points, based on a 2019 baseline (with an index set at 100). During the same period, global container shipping demand has only grown from a baseline of 100 points to 113 points. Even taking into account the impact of the current Cape of Good Hope route on TEU-miles, demand has only increased to 130 points, still far below supply growth.

Xeneta warns: “In the current context of severe global fleet oversupply, shipping companies face the enormous challenge of preventing freight rates from falling further.”