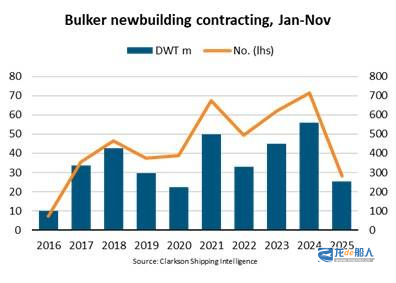

Data from the Baltic International Maritime Council (BIMCO) shows a sharp decline in new ship orders for the dry bulk carrier sector. Based on deadweight tonnage, new bulk carrier orders from January to November 2025 fell 54% year-on-year to 25 million dwt, marking the lowest level since 2020. Measured by vessel count, the decline was even more pronounced. Only 281 bulk carriers have been ordered globally so far in 2025, a sharp 61% year-on-year decrease, marking the lowest level since 2016.

As a result, new orders for dry bulk carriers have declined by 4% compared to the same period last year, currently accounting for only 11% of the total dry bulk fleet. BIMCO analyst Filipe Gouveia noted: “The drop in new ship orders is likely influenced by the uncertain market outlook.”

Despite a general decline in orders across all vessel types, the Capesize sector—the largest vessel type within the dry bulk fleet—has seen relatively robust order intake. This reflects market optimism regarding Capesize freight rates over the next two years. Although cargo demand growth may slow, extended voyage distances are expected to boost ton-kilometer demand.

Additionally, due to limited deliveries, the growth rate of Capesize bulk carrier supply is expected to remain low. However, approximately 77% of newbuildings ordered so far in 2025 are projected to be delivered after 2027.

In contrast, new orders for Supramax and Panamax bulk carriers have plummeted significantly, falling 76% and 55% year-on-year respectively. Given the relatively large backlog of orders for these two vessel types, deliveries are expected to surge substantially in 2026-2027. Combined with weak demand prospects and the potential return of vessels to the Red Sea route, this poses further downside risks to demand for these two vessel types. These factors may lead to weaker freight rates over the next two years, thereby suppressing newbuilding order demand.

Based on vessel capacity (deadweight tonnage), Chinese shipyards secured 81% of global bulk carrier orders, up 9 % points from 2024, while Japan’s market share correspondingly declined. Despite the U.S. previously announcing additional port fees on Chinese-built vessels (a policy now suspended), Chinese shipyards maintain absolute dominance in the bulk carrier sector. With cargo volumes to and from the U.S. accounting for only 8% of global freight traffic, coupled with multiple fee exemption policies, market preference for Chinese shipyards persists.

Economic factors present a mixed picture for potential buyers. Since 2025, a 3% decline in newbuild prices has been a key factor supporting bulk carrier orders, while prices for five-year-old secondhand bulk carriers have risen by 4%. Currently, the average price of five-year-old secondhand bulk carriers has reached 93% of newbuild prices, reflecting improved market conditions and freight rates in the latter half of the year. While lower prices could theoretically stimulate newbuilding demand, the extended delivery cycle for new vessels means that orders placed today may face a drastically different market environment upon delivery.

Environmental considerations continue to influence shipowners’ shipbuilding patterns, but priorities are shifting. By 2025, the proportion of new ship orders incorporating alternative fuel designs declined, while orders reserving space for future retrofits increased—a trend that may reflect ongoing uncertainty surrounding alternative fuel supply.