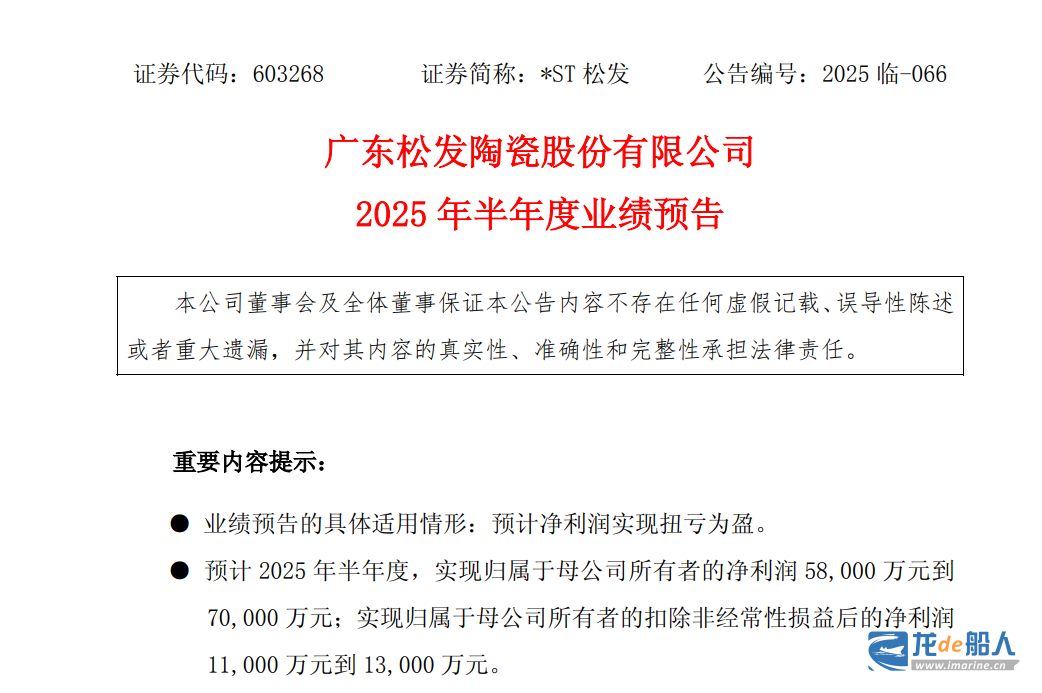

On July 13, Guangdong Songfa Ceramics disclosed its first performance forecast after the completion of the restructuring. It is expected that the net profit attributable to the parent company in the first half of 2025 will be RMB 580 million to RMB 700 million (approximately US$81 million to US$98 million), which is a full turnaround from loss to profit compared with the same period last year. This report card not only marks the staged success of the listed company’s strategic transformation, but also indicates that it will become an important force in the global shipbuilding and high-end equipment manufacturing fields.

Guangdong Songfa Ceramics has completed a landmark merger and acquisition in the capital market, strategically upgrading to high-end equipment manufacturing through the acquisition of 100% equity in Hengli Heavy Industries. As a cross-border merger and acquisition project, the transaction was efficiently completed after receiving approval from the China Securities Regulatory Commission in May 2025.

Hengli Heavy Industries has built a complete industrial chain from core components to whole ship manufacturing with its world-leading slipway/dock (the dock can simultaneously build four 300,000 DWT VLCCs) and annual production capacity of 180 marine engines. Hengli Heavy Industries can produce 180 marine engines per year, covering 12G95 main engines and below, and fully covering four dual-fuels: LNG, methanol, ammonia, and LPG, giving it a first-mover advantage in the green ship track. This acquisition not only opens up the strategic emerging business segment of shipbuilding for Songfa Ceramics, but also significantly enhances the overall competitiveness and risk resistance of the listed company.

At a critical time of profound changes and green transformation in the global marine economy, Hengli Heavy Industry has successfully achieved a leap from technological catch-up to innovation leadership with a reserve of 170 high-value-added orders scheduled to be produced until 2029. Hengli Heavy Industries has fully mastered the high-end shipbuilding capabilities by delivering benchmark ship types such as 306,000 DWT VLCC tankers, and seized the green ship replacement opportunities brought about by the IMO decarbonization policy, accelerating the layout of smart ships and high-end marine equipment manufacturing.

With the commissioning of the fundraising and investment projects and the high ship prices, Hengli Heavy Industries has formed a virtuous cycle of “order locking – technological breakthrough – capacity release”. In 2024, Hengli Heavy Industries’ new orders ranked fifth in the world and fourth in China, fully demonstrating its leading position in the global shipbuilding industry competition. At present, Hengli Heavy Industries’ rapid growth channel has been opened, and its future development prospects are broad.

Songfa Ceramics is financing through the capital market to support the strategic development of Hengli Heavy Industries, with a focus on investing in and constructing two core projects: the “Hengli Shipbuilding (Dalian) Green and High-end Equipment Manufacturing Base” and the “International Ship R&D and Design Center (Phase I)”. This initiative will significantly enhance the enterprise’s production efficiency and technological innovation capabilities, and further improve the manufacturing capacity of high-value-added ships and high-end equipment. Relying on the advantages of capital operation, Songfa Ceramics is making every effort to promote Hengli Heavy Industries to become a world-leading intelligent and green ship equipment manufacturer.