Alphaliner data shows that French container shipping giant CMA CGM officially exceeded 4 million TEU capacity this week, second only to Mediterranean Shipping Company (MSC) and Maersk’s 6.7 million TEU and 4.6 million TEU.

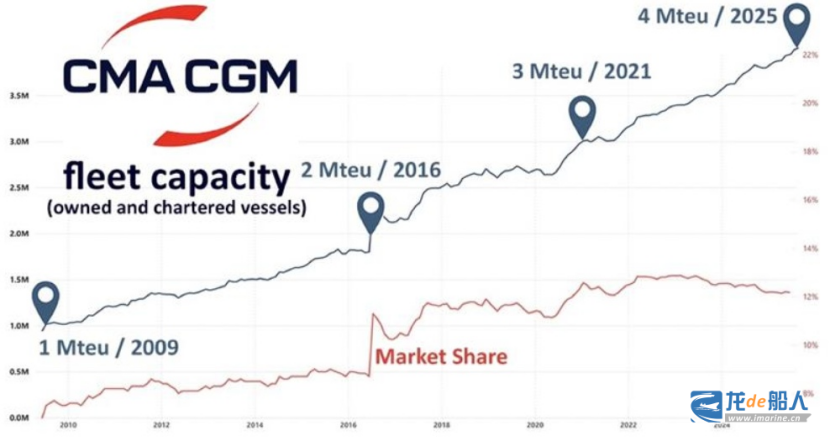

CMA CGM was founded in 1978 and is still privately owned by the Saadé family. It reached 1 million TEU for the first time in 2009, exceeded 2 million TEU in 2016, and reached 3 million TEU in 2021.

This latest milestone marks CMA CGM’s fourfold increase in capacity over the past 16 years (see chart below), further consolidating its position as the world’s third-largest container shipping company.

CMA CGM’s legendary growth journey includes a series of major acquisitions that reshaped its global layout. Landmark transactions include: the acquisition of French state-owned enterprise CGM in 1996, the acquisition of Australian shipping company ANL in 1998, the acquisition of Delmas in 2005, and the acquisition of American President Lines (APL) in 2016.

In addition, the group also acquired several regional shipping companies, including MacAndrews, Cheng Lie Navigation, OPDR, Mercosul Line, and Containerships Oy.

According to its official website, CMA CGM has 400 offices in 160 countries around the world. Headquartered in Marseille, it employs 160,000 people and operates in 420 commercial ports worldwide, with more than 250 service routes. In 2024, it achieved global revenue of US$55.5 billion.

Currently, CMA CGM operates a fleet of 683 container ships, including owned and leased ships. It has the second largest number of new ship orders in the container market, with a total of 95 new ships under construction and a total capacity of 1.5 million TEU, most of which are being built by Chinese shipyards.

With its massive new shipbuilding program, CMA CGM is poised to challenge Maersk, which ranks second in Alphaliner’s rankings. Although Maersk currently operates a capacity of 4.6 million TEU, the Danish giant has made it clear that it has no intention of further expanding its capacity, but rather focuses on replacing its aging fleet with an order list of 682,000 TEU.

Over the past five years, the wealthy Saadé family has led CMA CGM beyond its core shipping business to expand into logistics, air freight, and media.