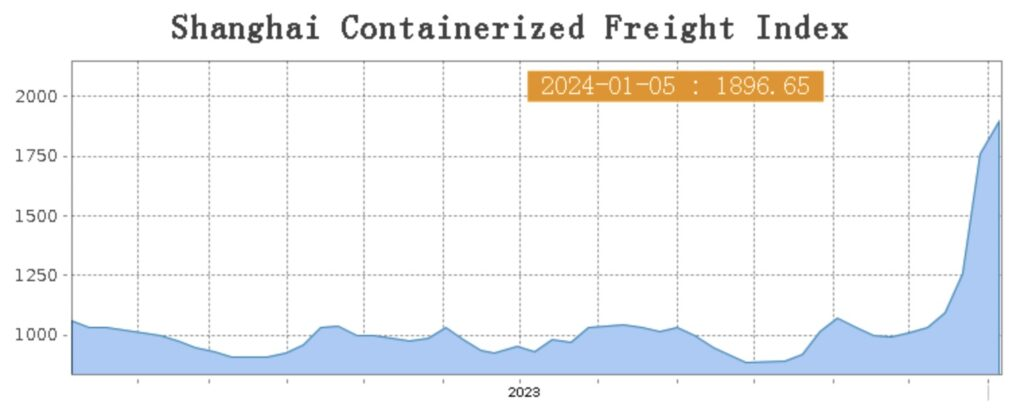

Having leapt by 40% last week, the Shanghai Containerized Freight Index (SCFI), the world’s most tracked spot index for box shipping, continued to climb today with a massive swathe of the liner fleet now making lengthy diversions to avoid the war-torn Red Sea.

The SCFI was up by another 8% this week, at 1896.65 points, a high not experienced since 2022.

According to major forwarder Kuehne+Nagel’s overview 405 container vessels with a capacity at 5.56m teu has been affected so far by the Houthis decision to target merchant shipping off Yemen in the wake of Israel’s war with Hamas.

Experts and analysts are forecasting the liner Red Sea exodus will remain in place for many weeks to come, soaking up tonnage and keeping rates high leading to stock upgrades for many liners.

Jefferies has raised its liner outlook for the year, citing the Red Sea disruptions leading to a much tighter market balance.

“The sudden change in fleet schedules has reduced near-term capacity and squeezed spot rates higher,” Jefferies noted in a new note to clients. According to Jefferies data, fleet supply/demand balance has jumped from a utilisation figure estimated at a weak 77% to a stronger 88%.

Jefferies expects spot rates to remain well-supported in the near-term but reckons the ongoing squeeze will abate as schedules are adjusted and more ships become available. However, Jefferies believes freight rates will likely establish a higher floor than previously expected given the overall disruptions and carriers can now expect to post positive margins in 2024.

Drewry published its keenly awaited first box spot rate details of the year yesterday, with the Red Sea shipping crisis sending rates rocketing.

The UK consultancy skipped a week during the festive period, so Thursday marked the first publication of the World Container Index since December 21.

Drewry’s global composite index was up by more than $1,000 over the past fortnight to $2,669.91 per feu while rates from Shanghai to Rotterdam have more than doubled, up 115%, to $3,577 per feu.

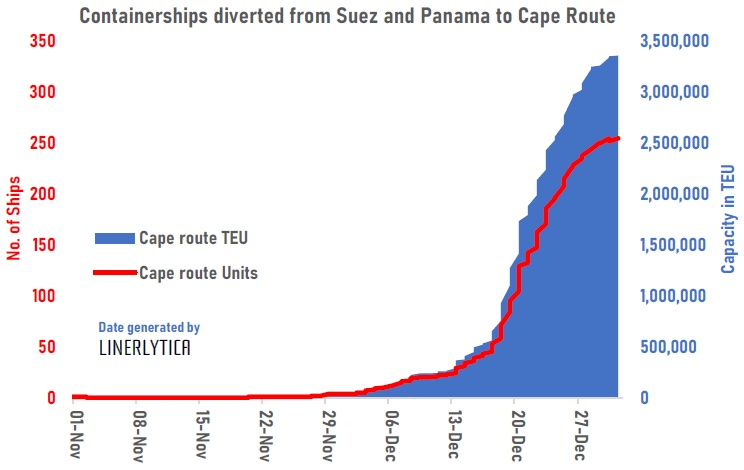

Analysts at Linerlytica, an Asia-based consultancy, expect elevated rates to hold through January and February as capacity will remain tight in the next six weeks.

“12% of global containership capacity is currently diverted to the Cape route and their numbers will continue to rise,” Linerlytica suggested in a report published earlier this week.

“Carriers may also be benefitting from firming demand, with Chinese exports growing for the first time in six months in November,” rival consultancy Alphaliner pointed out in its most recent weekly report.

In terms of new attacks, the US Navy reported yesterday the Houthis had sent an unmanned surface vehicle packed with explosives out to sea yesterday. It detonated without damaging any vessels but marks the 25th attempt to target shipping in the southern Red Sea since early November.

The latest attack came one day after 12 countries including the United States, Britain and Japan issued a joint statement cautioning the Houthis of unspecified “consequences” unless they halt attacks, in what one US official on Wednesday suggested was a final warning.

“These attacks need to stop or actions will be taken,” Britain’s foreign secretary, David Cameron, said yesterday, with the country’s defence minister, Grant Shapps, also tweeting: “The UK will not hesitate to take necessary & proportionate action should the Iranian-backed Houthis continue to put innocent lives at risk and threaten the global economy.”

The Houthi political bureau said in a statement yesterday that the establishment of a US-led alliance to protect ships represented a grave threat to the safety of international shipping in the Red Sea.

“America and its evil allies must realize that their malicious alliance won’t prevent Yemen from continuing to support Gaza through military operations targeting Israeli ships or those heading to occupied Palestinian ports,” the statement read.