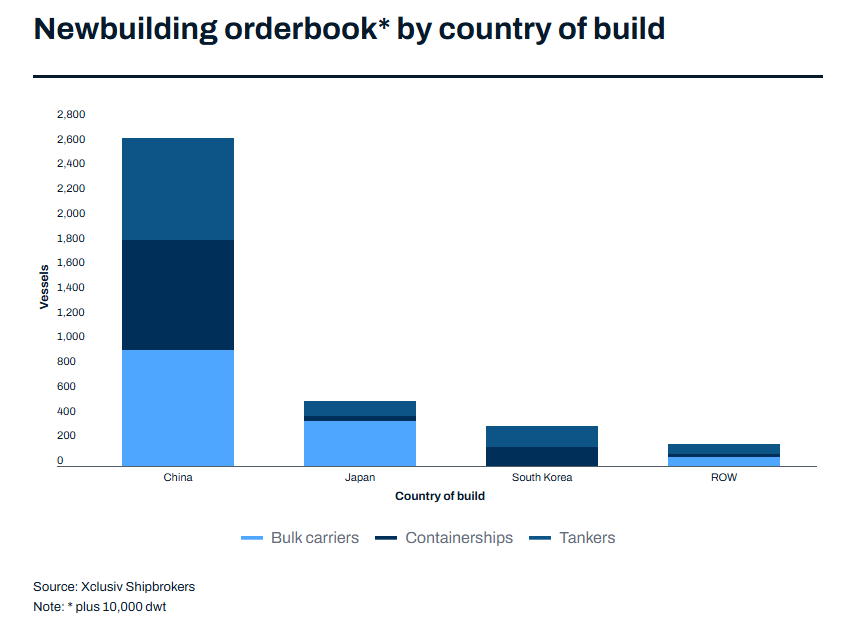

Currently, China holds a 68% market share in global bulk carrier orders, while in the tanker sector, approximately 69% of orders will be built by Chinese shipyards.

Chinese shipyards have secured over two-thirds of the world’s new bulk carrier and tanker orders, while Chinese shipowners’ share in these two major sectors continues to rise.

According to data from Xclusiv Shipbrokers, approximately 68% of the 1,375 bulk carriers currently under construction worldwide will be built by Chinese shipyards. This dominance is equally evident in the tanker sector, where 827 out of 1,203 new tanker orders globally (representing 69%) have been secured by Chinese shipyards.

Xclusiv Shipbrokers noted: “Chinese shipyards continue to hold a central position in the global newbuilding market, commanding an absolute dominant share in bulk carrier and tanker orders. This dominance not only underscores the unparalleled production capacity and price competitiveness of China’s shipbuilding industry, but also highlights China’s strategic considerations and core positioning in securing control over the global maritime supply chain.”

China’s influence as the world’s leading shipbuilder and major shipowner is growing, demonstrating its commitment to integrating its industrial strength with control over strategic logistics and energy flows.

Chinese private shipyards, which were once idle, have made a strong comeback, with Hengli Heavy Industries (formerly STX Dalian Shipyard) becoming a key force driving the expansion of China’s shipbuilding capacity.

Hengli Heavy Industries has recently demonstrated robust recovery momentum, securing a series of notable orders. In October alone, the shipyard secured orders for 20 Kamsarmax bulk carriers from multiple foreign shipowners, setting the highest monthly order intake record for a single Chinese shipyard this year.

Hengli Heavy Industries further confirmed last week that it has successfully secured orders for four Very Large Crude Carriers (VLCCs) from TMS Tankers, owned by George Economou. This follows the shipyard’s October contract for similar tankers with Dynacom, owned by John Fredriksen and George Prokopiou. Securing multiple large-scale orders from top international shipowners in quick succession underscores Hengli Heavy Industries’ growing core competitiveness and expanding global influence in the large tanker construction sector.

This trend is attributable to the solid cost competitiveness of Chinese shipyards, rapid technological advancements in ship design, and strong government support for the maritime industry.

Meanwhile, Chinese shipowners have become increasingly active in ordering bulk carriers in recent years, with total orders reaching 377 vessels to date. Among these, Ultra-handymax and Kamsarmax vessels account for the largest share, at 110 and 130 vessels respectively.

Additionally, domestic shipowners have ordered 18 very large ore carriers (VLOS) and 29 Newcastlemax bulk carriers. This initiative underscores Chinese shipowners’ investment in upgrading their long-haul bulk carrier fleets—particularly those transporting iron ore and coal on the Australia-Brazil route—aligning with the evolving demands of the global dry bulk shipping market.

Xclusiv Shipbrokers notes that Japanese shipowners, long known for their conservative, pragmatic approach and quality-focused ordering philosophy, are now showing increasing interest in China’s shipbuilding capabilities. Currently, Japanese shipowners have 96 bulk carriers under construction at Chinese shipyards, including 35 Ultra-handymax vessels, 35 Kamsarmax bulk carriers, 16 Handymax bulk carriers, and 10 Newcastlemax bulk carriers. This trend reflects Japan’s traditional strength in the mid-sized bulk carrier segment while also signaling Japan’s steady shift toward Chinese shipbuilding.

Chinese shipowners’ dominance extends equally to the tanker sector. Among the 827 tanker orders secured by Chinese shipyards, domestic shipowners have placed orders for 200 vessels, covering the full range of major tanker types. The order structure shows a significant proportion of small tankers, reflecting both the sustained surge in regional refined oil trade and the fleet renewal demand driven by the ongoing expansion of China’s independent refineries.

Meanwhile, Japanese shipowners have ordered 13 tankers from Chinese shipyards, including five VLCCs.

Given that Japanese shipyards are approaching full capacity and face relatively high costs, an increasing number of Japanese shipowners are turning their attention to Chinese shipyards, seeking cooperative solutions that combine delivery flexibility, cost competitiveness and construction quality.

Chinese shipyards have secured the vast majority of global container ship orders this year. Driven by surging demand for fleet renewal among major global liner companies, the market for new, highly efficient container ships continues to expand.

According to Alphaliner data, China currently accounts for approximately 74% of global container ship orders, equivalent to nearly 7.4 million TEUs of capacity.

Since the second quarter of 2025, against the backdrop of profound adjustments in the global trade landscape, continuously tightening international maritime emissions regulations, and shipping companies’ rising demands for vessel fuel efficiency, major shipping enterprises have accelerated the modernization and upgrading of their fleets. This has directly driven an explosive surge in global new ship orders. This robust surge in orders not only sustains market growth momentum but also further cements China’s absolute leadership in container ship construction, significantly outpacing traditional competitors like South Korea and Japan.

South Korean shipyards, which long dominated the high-end container ship market, continue to secure orders for large dual-fuel container ships. However, their market share has significantly declined due to the impact of Chinese shipyards’ increased production capacity and rapid technological advancement. This marks a profound shift in the competitive landscape of the global high-end container ship market.