On October 31, COSCO SHIPPING Development Co., Ltd. (COSCO SHIPPING Development) announced in multiple statements that, following approval by its board of directors, it will order 23 87,000 DWT bulk carriers from COSCO SHIPPING Heavy Industry (Dalian) and six 307,000 DWT Very Large Crude Carriers (VLCCs) from Dalian Shipbuilding Industry Corporation (DSIC). The total contract value amounts to RMB 12.4238 billion (approximately US$1.747 billion).

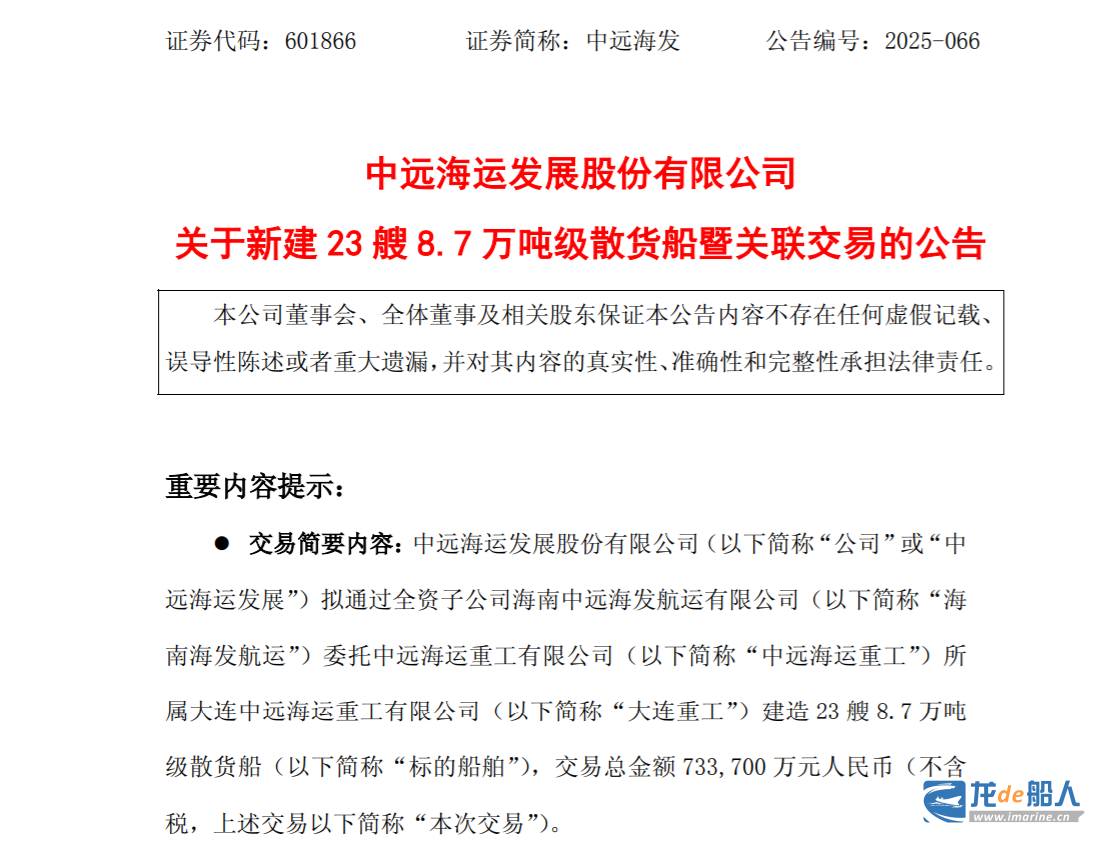

According to COSCO SHIPPING Development’s announcement regarding the construction of 23 new 87,000 DWT bulk carriers and related party transactions, COSCO SHIPPING Development plans to commission COSCO SHIPPING Heavy Industry (Dalian), a subsidiary of COSCO Shipping Heavy Industry, to build 23 87,000 DWT bulk carriers through its wholly-owned subsidiary, Hainan COSCO Shipping Development. The total transaction amount is RMB 7,337 million (excluding tax, approximately US$1.032 billion). The first vessel is expected to be delivered on or before May 20, 2027, with the others to be delivered successively before the end of 2028.

COSCO SHIPPING Development stated that the 23 newly built bulk carriers will be operated under long-term bareboat charters to COSCO Shipping Bulk or its designated subsidiaries.

According to the proposed vessel charter agreement, the charter period for each vessel will be 240 months ± 180 days from the date of delivery; the vessels are expected to be delivered gradually from mid-2027 to the end of 2028. After considering fuel and power system upgrades, the expected annual rental fee for each vessel after delivery will not exceed RMB 23,911,700 (excluding tax). Each vessel will be returned to Hainan COSCO Shipping Development upon the expiration of the charter period.

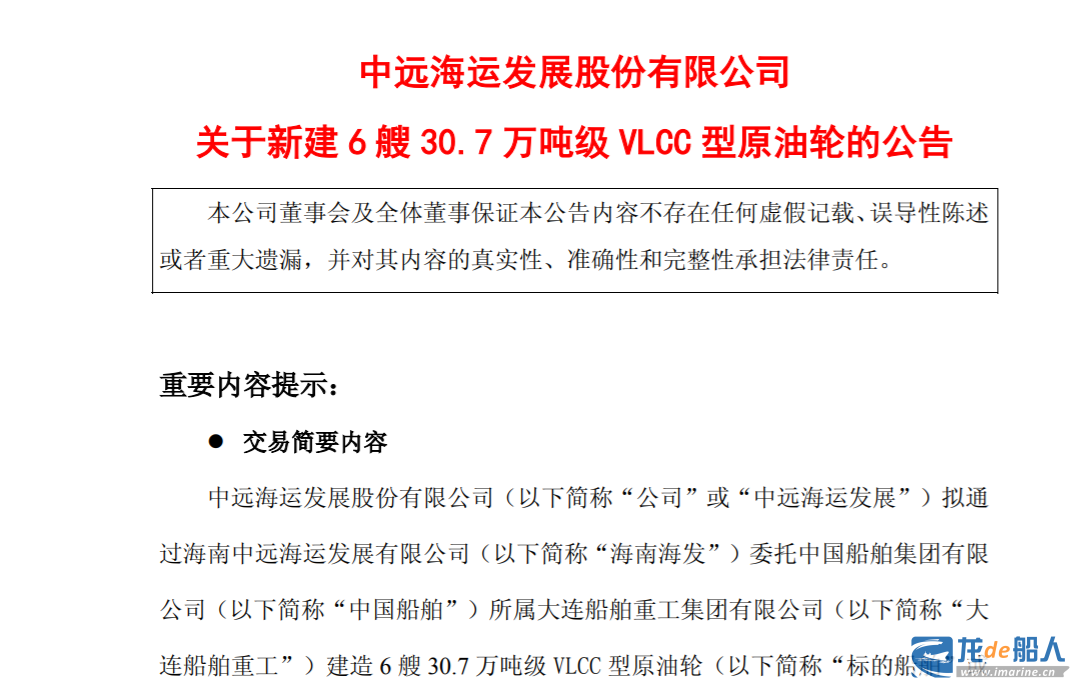

According to an announcement by COSCO SHIPPING Development regarding the construction of six new 307,000 DWT VLCCs, COSCO SHIPPING Development plans to commission DSIC through Hainan COSCO Shipping Development to build six 307,000 DWT VLCCs. The total transaction amount is RMB 5,086.8 million (excluding tax, approximately US$715 million), and the agreed price per vessel is RMB 847.8 million.

The announcement disclosed that the six VLCCs contracted by DSIC feature a dual-fuel design with methanol and LNG fuel options. The first vessel is scheduled for delivery in April 2027, with subsequent vessels to be delivered by the end of November 2028.

COSCO SHIPPING Development announced that the six VLCCs will be chartered on a long-term operating bareboat basis to COSCO SHIPPING Energy Transportation or its designated affiliated companies.

Under the proposed vessel charter agreements, each vessel will be chartered for a term of 240 months ± 90 days from the date of delivery. The six vessels are scheduled for delivery between April 2027 and November 2028. Upon lease expiration, each vessel will be returned to Hainan COSCO Shipping Development. The charter structure for the six VLCCs combines a “fixed time charter hire” for three vessels with a “minimum guarantee plus profit-sharing” arrangement for the remaining three.

Regarding the aforementioned new shipbuilding projects, COSCO SHIPPING Development stated that the company centers on the main line of the shipping and logistics industry, focusing on integrated development with container manufacturing, container leasing, and shipping leasing as its core businesses and investment management as support.

Aligning with COSCO Shipping Group’s vision of “accelerating the building of a world-class shipping technology enterprise”, it continuously deepens the integration of industry and finance to promote industrial development through finance, striving to become a world-class shipping industry-finance operator with COSCO SHIPPING characteristics.

COSCO SHIPPING Development is further implementing its strategic development plan as a shipping industry-finance operator, enhancing its capabilities in value discovery and value creation. Through this transaction, COSCO SHIPPING Development will further leverage its industry-finance synergy advantages, expand the scale and quality of its vessel assets, solidify the foundation for its vessel leasing business development, contribute long-term stable income and cash flow, improve the company’s overall financial stability, and strengthen its sustainable development momentum.