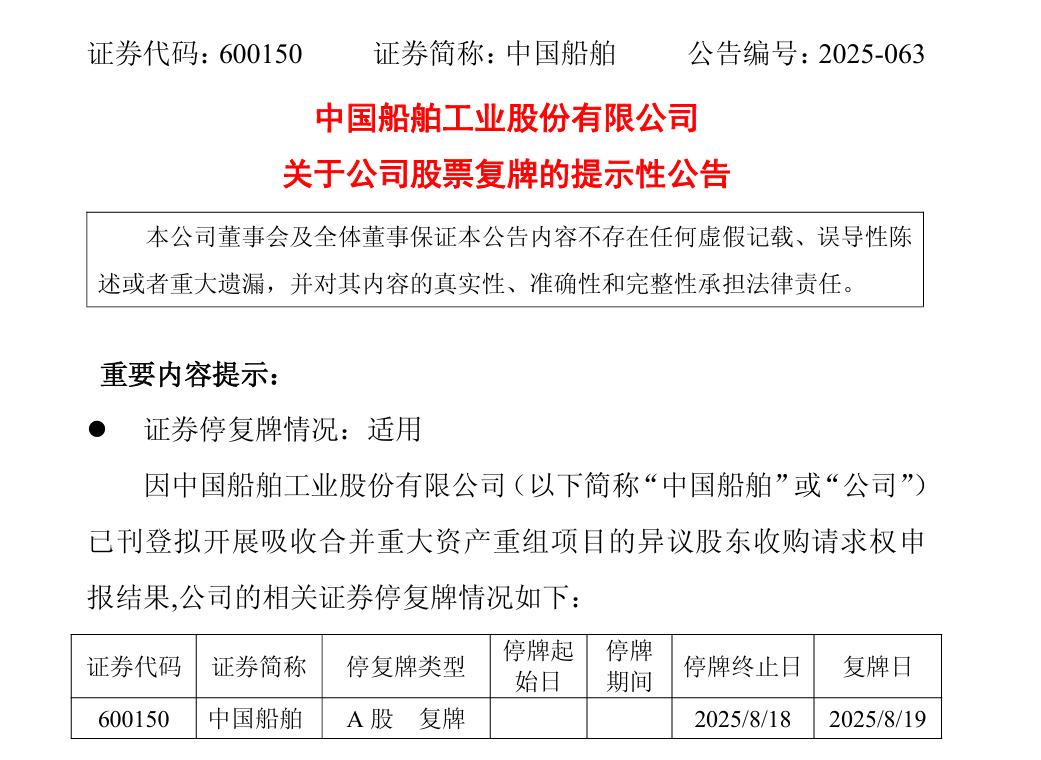

On August 18, China CSSC Holdings Limited (hereinafter referred to as “CSSC”) released the “Announcement on the Resumption of Trading of the Company’s Shares”.

The announcement disclosed that, upon application to the Shanghai Stock Exchange, CSSC shares will resume trading at the opening of the market on August 19.

According to an announcement, CSSC has published the results of dissenting shareholders’ acquisition request declarations for its proposed major asset restructuring project through a merger and absorption. Trading will be suspended from the opening of trading on August 13th for the declaration period, which ends on August 15th. Previously, the company announced plans to merge with China Shipbuilding Industry Company limited (CSIC) by issuing A-shares to all shareholders of the CSIC, with CSSC as the absorbing shareholder and CSIC as the absorbed entity.

CSSC stated that the record date for dissenting shareholders’ acquisition requests for the company’s shares is August 12, 2025, and the application period is from 9:30 AM to 11:30 AM and 1:00 PM to 3:00 PM, from August 13, 2025, to August 15, 2025. During the application period for dissenting shareholders’ acquisition requests for CSSC’s share-for-share merger with CSIC and related-party transactions, three shareholders submitted applications for 10,500 shares. After verification and elimination of invalid applications, the number of dissenting shareholders with valid acquisition requests is zero, and the number of valid dissenting shares is zero.

On the same day, CSIC issued an “Announcement on the Shanghai Stock Exchange Accepting the Company’s Application for Termination of Listing.”

The announcement disclosed that CSIC had submitted an application to the Shanghai Stock Exchange for voluntary delisting of its shares on August 14, 2025, and received the “Notice on Acceptance of CSIC’s Application for Voluntary Delisting of Shares” issued by the Shanghai Stock Exchange on August 18.

According to the notice, the Shanghai Stock Exchange has decided to accept CSIC’s application for voluntary delisting. CSIC will publish a relevant delisting announcement after approval by the Shanghai Stock Exchange.

According to a previous announcement, CSSC will merge with CSIC by issuing A-shares to all CSIC exchange shareholders. CSSC is the absorbing party and CSIC is the absorbed party. This means that CSSC will issue A-shares to all CSIC exchange shareholders in exchange for their CSIC shares.

Upon completion of this share exchange and absorption merger, CSIC will cease listing and its legal person status will be cancelled. CSSC will inherit and take over all of CSIC’s assets, liabilities, businesses, personnel, contracts, and all other rights and obligations. CSSC will apply to list the A-shares issued as a result of this share exchange and absorption merger on the Shanghai Stock Exchange’s main board. The transaction value reached 115.15 billion yuan, making it the largest absorption merger in A-share history.