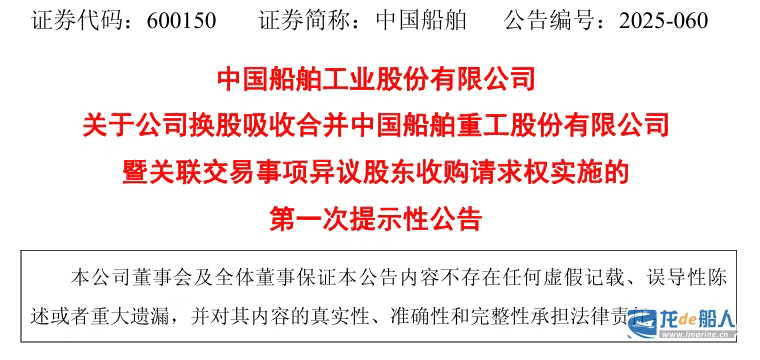

On August 12, China CSSC Holdings Limited (CSSC) issued the “First Indicative Announcement on the Implementation of the Dissenting Shareholders’ Acquisition Request Rights in the Company’s Share Exchange and Absorption Merger of China Shipbuilding Industry Company limited (CSIC) and Related Transactions.”

The announcement disclosed that the exercise price of CSSC’s dissenting shareholders’ acquisition rights is 30.02 yuan per share. The closing price of the company’s stock on August 12, 2025, was 38.50 yuan per share, representing a 28.25% premium to the exercise price of this acquisition right. If CSSC’s dissenting shareholders exercise their acquisition rights, they may incur certain losses. Please be aware of the risks. CSSC’s stock will be suspended on August 13.

The announcement stated that after the expiration of this application, the CSSC will separately announce the application results. Trading of the company’s shares will resume on the same day as the announcement of the dissenting shareholder’s acquisition request results (estimated to be approximately 3-5 trading days after the acquisition request deadline of August 15, 2025). Once the Shanghai Stock Exchange approves CSIC’s application for delisting, CSIC will publish a delisting announcement, and the CSSC will issue a share swap implementation announcement and determine the record date for the share swap, before commencing the share swap.

On August 4th, CSSC and CSIC both issued “Informative Announcements Regarding Continuous Trading Suspensions of Stocks.” The announcements stated that CSSC intends to merge with CSIC by issuing A-shares to all CSIC shareholders. CSSC will be the absorbing party and CSIC will be the absorbed party. The transaction has been approved by the China Securities Regulatory Commission, and CSSC will handle related matters as soon as possible. To ensure the smooth exercise of dissenting shareholders’ cash options, trading in the shares of CSSC and CSIC will be suspended from the opening of the market on August 13th until delisting, with no further resumption of trading.

Upon completion of the merger, CSIC will cease listing and cancel its legal person status. CSSC will inherit and take over all of CSIC’s assets, liabilities, businesses, personnel, contracts, and all other rights and obligations. CSSC will apply to list and trade A shares issued as a result of this share exchange and absorption merger on the Shanghai Stock Exchange’s main board.

It is worth mentioning that this transaction will completely integrate CSIC’s three major shipbuilding bases, creating a new global shipbuilding giant with total assets exceeding 400 billion yuan (approximately US$55.76 billion) and revenue exceeding 130 billion yuan (approximately US$18.122 billion).