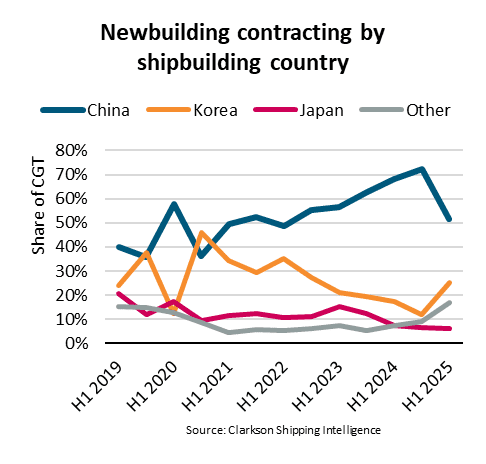

According to the latest data from the Baltic and International Maritime Council (BIMCO), in the first half of 2025, the global market share of Chinese shipyards dropped sharply to 52% from 72% in the same period last year.

Filipe Gouveia, BIMCO’s shipping analysis manager, said: “In the first half of 2025, China’s share of new ship orders fell from 72% to 52%. Growing concerns about the Office of the United States Trade Representative (USTR)’s upcoming charges on Chinese ships in US ports are one of the reasons for the decline in new ship orders from China, which is further exacerbated by the decline in global new ship orders and a shift in the types of ships ordered.”

The USTR port fee policy, which is set to take effect in October 2025, will affect both ships operated by Chinese shipowners and ships built in China. According to industry-specific standards and exemption clauses for short-haul routes, only some small ships built in China will be exempt.

According to BIMCO’s analysis, global new ship orders (measured in compensated gross tonnage, CGT) plummeted by 54% year-on-year in the first half of 2025. Among them, bulk carriers, oil tankers, and gas carriers were hit hardest by weak freight rates, while container ships and cruise ships were the only two sectors to see growth.

China continues to dominate the global shipbuilding industry, but South Korea has also made progress in key sectors recently. In 2024, South Korea was the leader in the construction of gas carriers, and this year, South Korea surpassed China in the construction of crude oil tankers.

Gouveia noted that alternative shipbuilding capacity remains limited: “Even if shipowners try to avoid ordering ships in China due to USTR fees, there is a ceiling on available capacity outside of China. Therefore, if the sharp drop in global ship orders at the beginning of this year is removed, China’s market share may be higher.”

Industry capacity constraints have led to order backlogs and significantly longer delivery cycles, especially for large and special ships (such as large container ships, gas carriers, and cruise ships). Among new ship orders this year, 31% are scheduled for delivery in 2027, 38% in 2028, and 23% in 2029 and beyond.

As the world’s second and third largest shipbuilding countries, South Korea and Japan face severe challenges in expanding production capacity due to labor shortages caused by population decline, while demographic problems have led to rising labor costs, ultimately affecting their competitiveness in the global market.

Looking ahead, Gouveia believes that “despite recent setbacks, China’s shipbuilding dominance will remain difficult to shake in the short term, but it may face increasing competition in the medium term. Existing small-scale bulk carrier/tanker builders such as the Philippines and Vietnam, benefiting from low labor costs, may increase production. Meanwhile, although the current shipbuilding capacity of the United States and India is limited, both governments are actively working to strengthen their local shipbuilding industries – but it will take time to achieve large-scale production.”