On January 16, *ST Songfa issued an announcement stating that the construction contract for four 306,000 DWT Very Large Crude Carriers (VLCCs) and one LR2 crude oil/product tanker of its subsidiary Hengli Shipbuilding (Dalian) Co., Ltd. will be signed and take effect on January 15, 2026.

According to the announcement, the four 306,000 DWT VLCCs are valued at a combined total of approximately $400 million to $600 million. The vessels are owned by a single-ship company under Greece’s Dynacom Tankers Management and are scheduled for delivery in the second half of 2028.

Dynacom Tankers is a shipping enterprise with significant influence in the maritime sector, specializing in the operation and management of oil tankers, bulk carriers and LNG vessels. Backed by its Suezmax tankers and VLCCs, the company has established a deep presence in the crude oil and product tanker market, boasting an extensive and solid operational track record within the global maritime logistics industry.

Another 114,000 DWT LR2 crude/product tanker has been contracted for approximately $70 million to $100 million. The buyer is a well-known European shipowner, with delivery scheduled for the second quarter of 2027.

This marks the second new shipbuilding contract announced by Hengli Heavy Industries since the start of 2026. Previously, on January 14, the shipbuilder announced the signing of an order for two 306,000 DWT VLCCs from a single-vessel company under Seatankers Management. The total contract value is approximately $200-300 million, with deliveries scheduled for the second half of 2028.

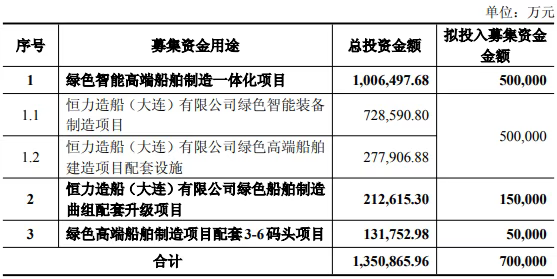

Notably, on January 14, Hengli Heavy Industries’ listed entity *ST Songfa announced a “2026 Pre-Plan for Issuing Shares to Specific Parties.” According to the plan, the company intends to invest 13.5 billion yuan (approximately US$1.937 billion) in three shipbuilding capacity expansion projects. Of this amount, 7 billion yuan (approximately US$1.004 billion) is to be raised through a private placement of A-shares to specific investors.

According to the plan, the 13.5 billion yuan will be used for: the integrated green intelligent high-end shipbuilding project, the green shipbuilding supporting upgrade project for curved hull block manufacturing of Hengli Shipbuilding (Dalian) Co., Ltd., and the supporting Berths 3-6 project for the green high-end shipbuilding project. The investment amounts for the three projects are approximately 10.065 billion yuan, 2.126 billion yuan, and 1.318 billion yuan, respectively, with planned investments of 5 billion yuan, 1.5 billion yuan, and 500 million yuan from the raised funds, respectively, as follows: