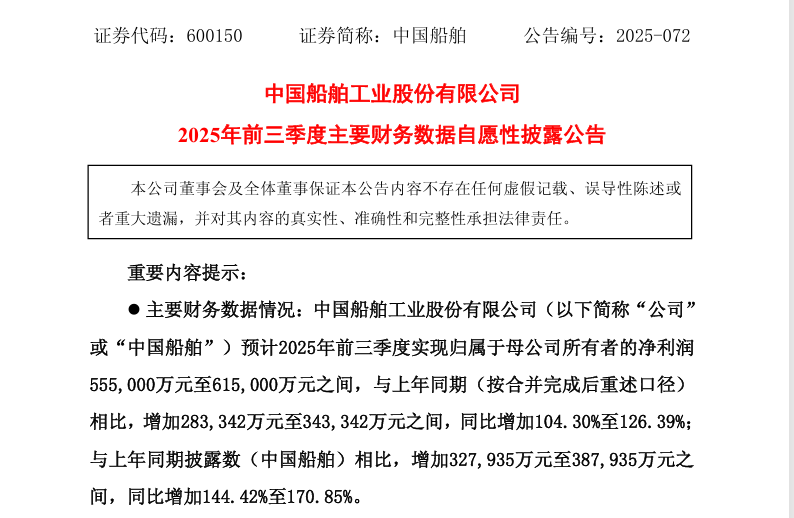

On October 20, China CSSC Holdings Limited (CSSC) released the “Voluntary Disclosure Announcement of Key Financial Data for the First Three Quarters of 2025”.

The announcement disclosed that CSSC expects to achieve a net profit attributable to shareholders of RMB 5.55 billion to RMB 6.15 billion (approximately US$780 million to US$864 million) in the first three quarters of 2025, a year-on-year increase of 104.30% to 126.39%; it expects to achieve a net profit attributable to shareholders of RMB 4.08 billion to RMB 4.68 billion (approximately US$573 million to US$658 million), a year-on-year increase of 106.93% to 137.36%.

The announcement specifically mentioned that, based on an overall accounting basis, CSSC expects to achieve a net profit of RMB 7.54 billion to RMB 8.14 billion (approximately US$1.059 billion to US$1.144 billion) in the first three quarters of 2025. This data difference is due to the consolidation accounting rules. CSSC purchased a 47.63% stake from the original controlling shareholder of China Shipbuilding Industry Company Limited (CSIC) and its concerted parties. When preparing the consolidated financial statements, only this portion of the equity was included in the consolidation scope, and the remaining shares of CSIC were reported as minority shareholders’ interests.

CSSC stated that during the reporting period, the company focused on its core responsibilities and primary business. While ensuring production safety, it intensified efforts to secure production and ensure delivery, enhanced lean management practices, and steadily improved production efficiency. Concurrently, the shipbuilding industry maintained a favorable development trajectory overall, with the company achieving an upgraded and optimized order portfolio. The number and value of commercial vessels delivered during the reporting period both increased year-on-year, supported by effective construction cost control, resulting in a year-on-year rise in gross operating profit. The operating performance of associated companies continued to improve.