London-headquartered broker Gibson is reporting that there are now no suezmax newbuild slots left in China for 2026.

“As a result,” Gibson stated in a recent report, “we are seeing a number of owners spar with the Korean/Japanese yards on what pricing can really be achieved for deliveries across 2026.”

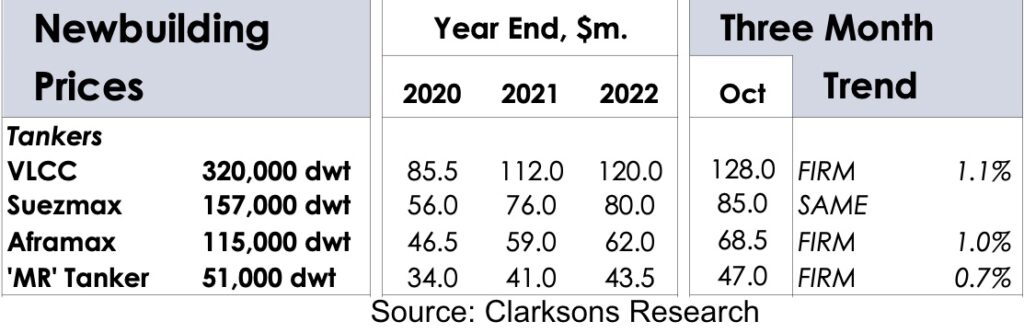

In South Korea, yards would like to see $85m with scrubbers included, historically high levels.

Aiding yards in their negotiations are the scarcity and elevated prices for modern secondhand tonnage with Gibson highlighting how a seven-year-old suezmax has just been sold for $72m.

Clarksons Research lists the asking price of a 157,000 dwt suezmax today at $85m, up by nearly $30m from the end of 2020. Clarksons data shows there are currently just 55 suezmaxes on order, equivalent to 8.3% of the extant fleet.

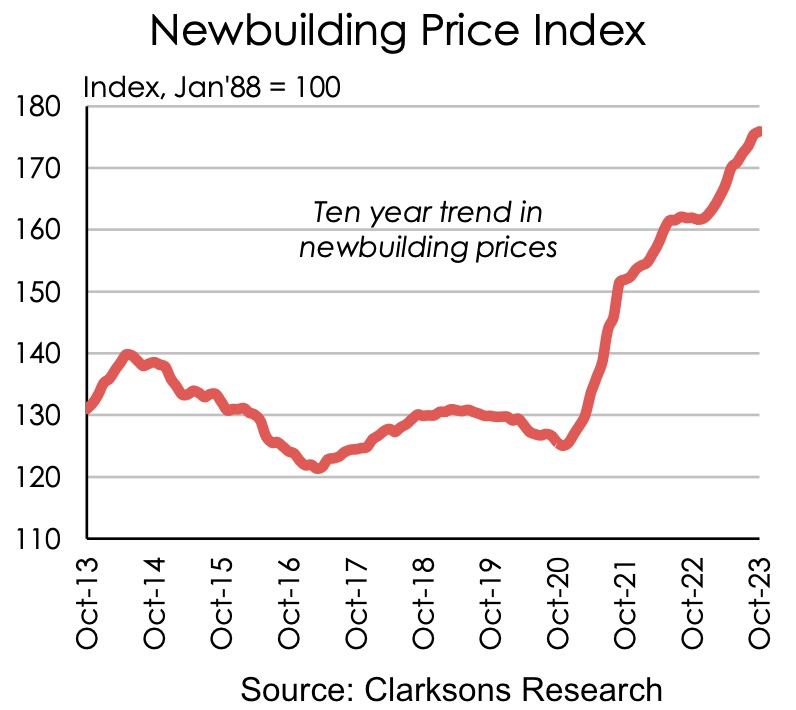

“Newbuild prices have continued to firm across 2023 so far on the back of depleted slot availability at yards (start-Oct: forward cover at 3.6 years) and general inflationary pressures, including rising labour costs,” Clarksons stated in its most recent weekly report, pointing out that newbuild prices are up 9% year-on-year (see chart below).

It is not just suezmax owners who face an increasingly long search for available newbuild slots. With fully 50% of the global orderbook in cgt terms contracted for just two shipping segments, LNG and containers, other sectors such as dry bulk and tankers now have a long wait for spaces to open up.

According to data from Maritime Strategies International (MSI) carried in class society ABS’s recently published 2023 Outlook, shipyard capacity grew 1.8% to 67.1m gt last year with MSI forecasting this figure will rise to 69m gt by 2025, and will peak at 81m gt in 2030. While this is significantly above current levels, it remains 26% below the 2011 peak.

The Review of Maritime Transport 2023 published by the United Nations Conference on Trade and Development (UNCTAD) last month urged shipyards to expand quickly to aid with shipping’s green transition.

“Shipyard capacity is currently facing constraints. Tanker and dry bulk owners are anticipating long waiting times and high building prices. Increasing shipbuilding capacity is crucial to ensure that shipping meets global demand and its sustainability goals,” the UNCTAD report stated.