On the evening of July 10, China State Shipbuilding Corporation (CSSC) and China Shipbuilding Industry Corporation (CSIC) both released the “2025 Semi-annual Performance Forecast Announcement”, with both companies expecting a significant year-on-year growth in profits.

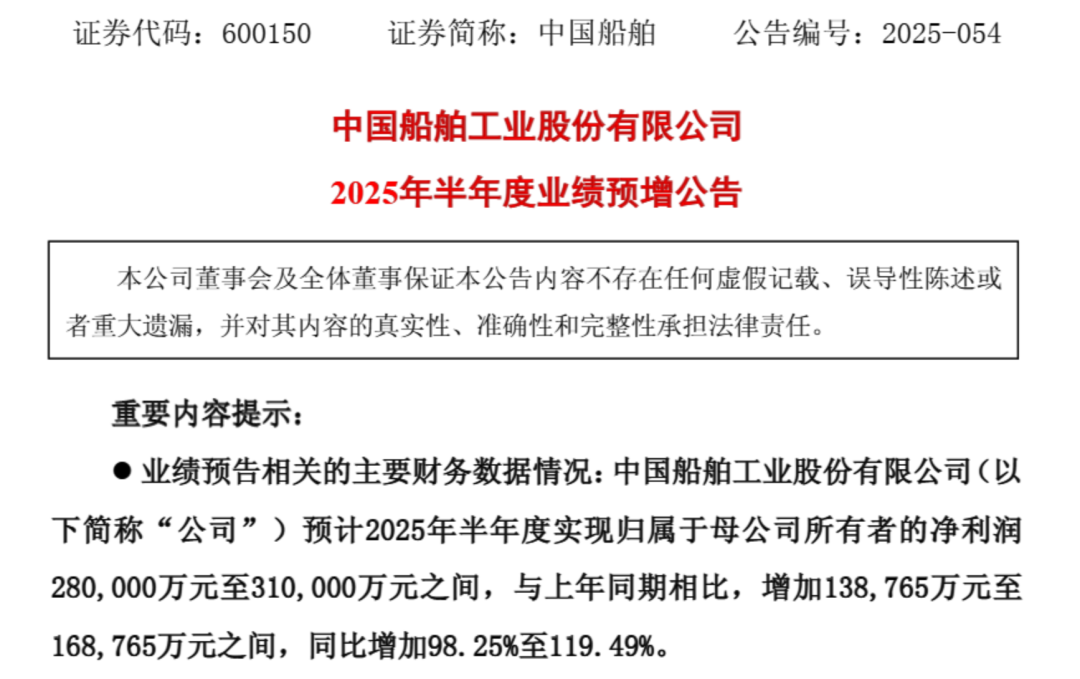

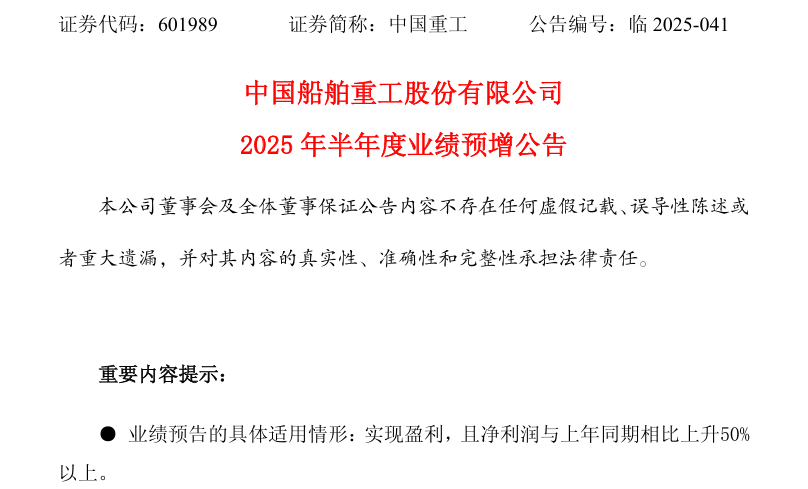

The announcement disclosed that in the first half of 2025, CSSC expects its net profit attributable to shareholders of the parent company to be 2.8 billion yuan (approximately US$391 million) to 3.1 billion yuan (approximately US$432 million), a year-on-year increase of 98.25% to 119.49%; CSIC expects its net profit attributable to shareholders of the parent company to be 1.5 billion yuan (approximately US$209 million) to 1.8 billion yuan (approximately US$251 million) in the first half of the year, a year-on-year increase of 181.73% to 238.08%.

CSSC stated that during the reporting period, the company focused on its main responsibilities and businesses, and under the premise of ensuring production safety, it paid close attention to production and delivery, improved the level of lean management, and steadily improved production efficiency; the shipbuilding industry as a whole maintained a good development trend, and the company’s order structure was upgraded and optimized; the price of civilian ships delivered during the reporting period increased year-on-year, the construction cost was properly controlled, and the operating gross profit increased year-on-year; the operating performance of the joint ventures continued to improve. Affected by the above factors, the company’s performance for this period is expected to increase.

CSIC stated that during the reporting period, the company grasped the development trend of the shipbuilding industry, further leveraged the advantages of batch construction of major ship types, strengthened lean management, deepened cost control, and focused on improving efficiency and benefits. The number of civil ship products delivered increased significantly, operating income increased accordingly, and operating performance improved significantly year-on-year.

On July 4, CSIC issued an announcement that the merger of CSIC was approved by the Shanghai Stock Exchange, which means that the preliminary regulatory review of the merger and acquisition transaction between the two listed shipbuilding companies has been basically completed and will enter the implementation stage in the future.

In this transaction, CSSC is the absorbing party and CSIC is the absorbed party. After the transaction is completed, the actual controller of CSSC will still be China State Shipbuilding Corporation Limited and the ultimate controller will still be the State-owned Assets Supervision and Administration Commission of the State Council.

The transaction plan shows that the exchange price of CSSC is determined to be 37.84 yuan per share based on the average stock trading price in the 120 trading days before the pricing base date, and the average stock trading price of CSIC is determined to be 5.05 yuan per share. The exchange ratio between CSIC and CSSC is determined to be 1:0.1335, that is, every 1 share of CSIC can be exchanged for 0.1335 shares of CSSC.

Upon completion of this transaction, CSIC will be delisted and its legal entity status will be revoked. All of its assets, liabilities, businesses, personnel, contracts, etc. will be assumed by CSSC. The A-shares issued by CSSC in this share exchange merger will be listed and traded on the main board of the Shanghai Stock Exchange.

After the completion of this restructuring, major core shipbuilding and repair yards under China State Shipbuilding Corporation (CSSC), including Jiangnan Shipyard, Dalian Shipbuilding Industry Corporation (DSIC), Shanghai Waigaoqiao Shipbuilding, Wuchang Shipbuilding Industry Group, Guangzhou Shipyard International, Beihai Shipbuilding, and CSSC Chengxi Shipyard, will be integrated into the merged CSSC. CSSC will thus become the world’s largest flagship listed shipbuilding company, leading the global market in terms of the scale of 手持船舶订单.

After the completion of this reorganization, the main core shipbuilding and repairing yards under CSSC, including Jiangnan Shipyard, Dalian Shipyard, Waigaoqiao Shipyard, Wuchang Shipyard, Guangzhou Shipyard International, Beihai Shipyard, and CSSC Chengxi, will be integrated into the merged CSSC. CSSC will become the world’s largest flagship shipbuilding listed company with the volume of its shipbuilding orders.