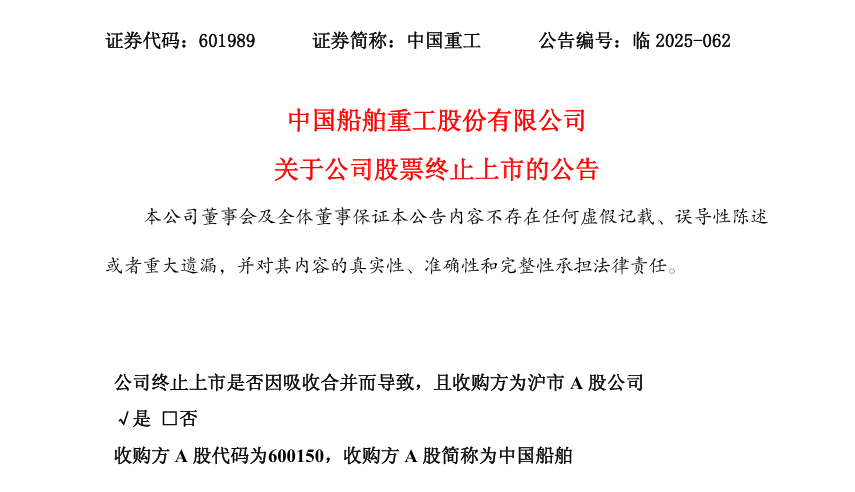

On August 29, China Shipbuilding Industry Company Limited (CSIC) issued an announcement regarding the termination of its stock listing.

The Shanghai Stock Exchange announced that it has delisted CSIC’s A-shares, primarily due to a merger with China State Shipbuilding Corporation Limited (CSSC). CSIC’s A-shares will be delisted on September 5, 2025, and will not enter into a delisting settlement period.

According to the announcement, after the A-share stock of CSIC is delisted, it will be converted into A-share stock of CSSC at a ratio of 1:0.1339. The A-share stock of CSIC will no longer be displayed in the stock accounts of CSIC A-share shareholders. After the conversion is completed, the CSSC A-share stock will be displayed in their stock accounts starting from the listing date of the newly added shares, and the corresponding stock market value will be reflected in the total market value of the investors’ accounts.

According to public information, CSIC and CSSC are two A-share listed companies under China CSSC Holdings Limited. CSIC, established in March 2008 and listed in December 2009, is a ship R&D, design, and manufacturing company with five main business segments: marine defense and development equipment, marine transportation equipment, deep-sea equipment, and ship repair and conversion. CSSC, the core military and civilian arm of China CSSC Holdings Limited, specializes in shipbuilding (military and civilian), ship repair, offshoree engineering and electromechanical equipment.

In September 2024, CSSC announced that it and CSIC were planning a share-for-share merger, with CSSC issuing A-shares to all CSIC shareholders. On January 7, 2025, CSSC and CSIC announced that the State-owned Assets Supervision and Administration Commission of the State Council and other relevant authorities had issued approval in principle for the overall transaction plan.

On July 4th of this year, the Shanghai Stock Exchange approved the merger of CSSC and CSIC. This marked the official completion of the largest merger in the history of the A-share market. The merged CSSC will consolidate the assets, orders, and technical expertise previously dispersed across the two listed companies into a single, more powerful “capital container,” transforming it into the world’s largest listed shipping company.

Notably, according to the latest first-half 2025 performance reports disclosed by both companies, the combined total assets of the new entity will exceed RMB 400 billion (approximately US$56.08 billion).