According to a report by Greek shipbroker Xclusiv Shipbrokers, Greek shipowners placed orders for a total of 73 new ships in the first half of 2025, a sharp decline of 58% from 176 in the same period last year. This downward trend is also reflected globally, with global shipowners’ orders falling from 1,169 in the first half of 2024 to 423 in 2025, a decline of 63%.

Due to market uncertainty caused by the proposed port fees in the United States, Korean shipyards have become the first choice for Greek shipowners. In the first half of 2025, nearly 65% of new ship orders from Greek shipowners were taken by Korean shipyards, while the proportion of Chinese shipyards dropped to 30% and Japan accounted for about 6%.

The above changes are reflected in different ship types. In the first half of 2025, in the tanker sector, 72% of Greek shipowners’ orders went to Korean shipyards, a significant increase from 16% in 2024; Chinese shipyards fell from 78% to 28%. In the container ship sector, Korean shipyards jumped from 0% to 61%, while Chinese shipyards fell from 100% to 39%; a similar trend was seen in the bulk carrier sector, with Japanese shipyards occupying an absolute position, while Chinese shipyards’ market share among Greek shipowners declined significantly.

In the liquefied natural gas (LNG) carrier market, in the first half of 2025, South Korean shipyards had a market share of 80%, and the remaining 20% was undertaken by Japanese shipyards. Chinese shipyards did not receive any new ship orders during this period. In the same period last year, China, South Korea and Japan accounted for 17%, 69% and 14% of the market respectively.

Greek shipowners give priority to ordering container ships

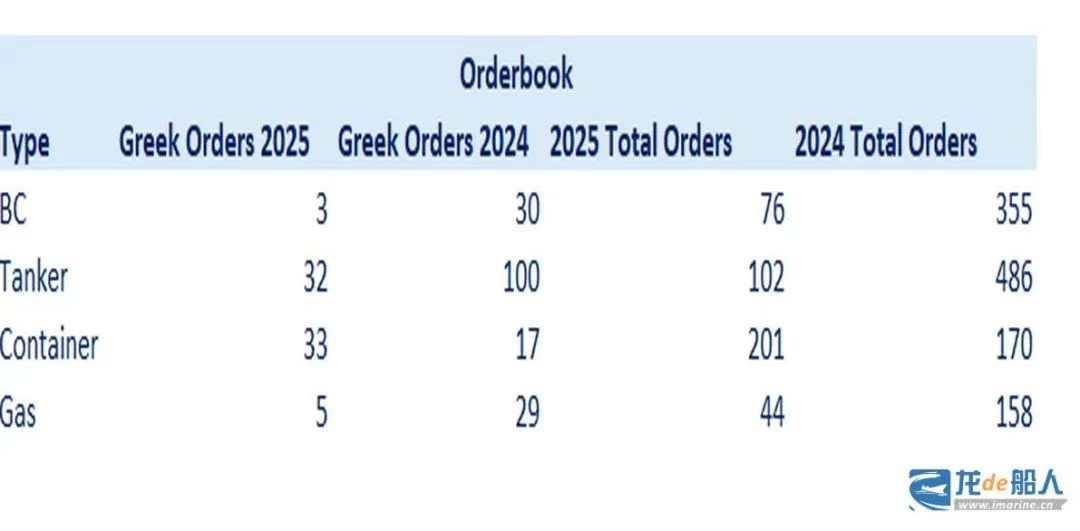

Among all types of ships, container ships are the first choice for Greek shipowners, with a total of 33 ships ordered in the first half of 2025, an increase from 17 ships in 2024. It is worth noting that this is the only market segment that has achieved year-on-year growth worldwide, with global orders of 201 ships, compared with 170 ships in the first half of 2024.

Xclusiv Shipbrokers analysts said: “This growth reflects shipowners’ strategic moves to modernize their fleets and promote environmental compliance, and container ships are also leading the way in alternative fuels, thanks to their predictable trade routes. Shipowners are gradually retiring older ships in favor of newbuilds equipped with dual-fuel engines, alternative propulsion technologies and enhanced energy efficiency. This trend is in line with increasingly stringent environmental regulations and pressure from cargo owners to decarbonize the supply chain.”

Other factors that prompted Greek shipowners to place orders for container ships include the following: some Asian shipyards can deliver ships as early as the end of 2026 or 2027, especially medium-sized and feeder container ships, which makes container ships more attractive than over-ordered LNG carriers and tankers; modern second-hand container ships are in limited supply and have high resale prices. In contrast, newbuildings offer better fuel efficiency, compliance with regulatory requirements and longer commercial life.

The growth rate of tanker orders slowed down and ranked second

Tankers ranked second in the shipbuilding plans of Greek and global shipowners. In the first half of 2025, Greek shipowners placed orders for 32 ships, a significant decrease from 100 ships in 2024. Global orders fell from 486 to 102 ships.

“Tanker freight rates have been volatile and in some cases disappointing – particularly in the product tanker segment – while newbuilding prices remain high, undermining owners’ confidence in long-term capital projects,” said analysts at Xclusiv Shipbrokers.

Geopolitical tensions are disrupting trade flows and complicating demand forecasts, making speculative orders unattractive. In addition, fuel uncertainty remains a major concern in the tanker sector, with many shipowners adopting a cautious “wait-and-see” attitude.

Bulk carrier new orders plummet

In the first half of 2025, bulk carrier orders were almost non-existent in Greek shipowners’ shipbuilding plans, with 3 orders placed in the first half of 2025, a sharp drop from 30 in the same period of 2024. Correspondingly, the global order volume of bulk carriers also dropped from 355 to 76.

Xclusiv Shipbrokers analysts said: “The sluggish bulk carrier orders are attributed to the continued low freight rates and high new ship construction costs. In addition, the strong new shipbuilding projects in recent years, combined with low dismantling levels, have raised concerns about future oversupply.”

In 2024, 581 new bulk carriers were added to the global fleet, with an expected 632 in 2025, 530 more in 2026, and 474 delivered annually starting in 2027. Analysts warned, “If the steady stream of newbuildings cannot be offset by dismantling or increased demand, it could continue to put pressure on market fundamentals and exacerbate shipowners’ uncertainty about future investments.”

LNG carrier orders fall

In the gas carrier sector, new ship ordering activity was also sluggish. In the first half of 2025, a total of 44 new ships were ordered worldwide, compared with 158 in the same period last year. During the statistical period, Greek shipowners only ordered 5 LNG carriers, 29 fewer than in the first half of 2025.

Analysts believe that the slowdown in orders is due to the surge in LNG carrier orders between 2023 and 2024, which was mainly driven by European policies to diversify energy sources and reduce dependence on Russia. With many shipowners having completed fleet upgrades or expansions, the market is currently undergoing a natural adjustment period.

Another reason is that shipyards with the capacity to build LNG carriers are already operating at near full capacity, with delivery dates pushed back to 2028 or later, making new orders unattractive due to long waiting times and delivery uncertainties.

In addition, major charterers are becoming more selective, with the 2023-2024 boom relying on long-term charters – many of which have already been locked in. Speculative orders are at greater risk as fewer long-term contracts are currently available.

Xclusiv Shipbrokers concluded that, in the absence of definitive charter contracts, LNG carrier projects are difficult to finance, further dampening shipowners’ enthusiasm for newbuildings.